Iowa Republican legislators are frustrated that money for Iowa in the COVID-19 relief bill could interfere with their plan to provide big tax breaks for the wealthy.

In a press conference with Statehouse reporters today, Speaker Pat Grassley said that provisions in the relief bill just signed today by President Joe Biden could impede their efforts on that front. The new law, passed solely by support from Democrats, includes a provision that forbids states from using the funding meant for COVID relief efforts on tax cuts — or to offset the cost of tax cuts in other parts of the budget.

“I think first and foremost, we need to get an answer on whether what the feds passed … if you even have the ability to pass tax cuts,” Grassley said.

[inline-ad id=”1″]

As the Iowa Capital Dispatch reported, Republicans’ priority this year is to “phase out the state inheritance tax over three years … leaders are also working on plans to accelerate the 2018 income tax cuts … If that happens, the top income-tax rate will fall from 8.53% to 6.5%.”

Eliminating the inheritance tax would mostly only help the state’s wealthiest residents. So too, obviously, would be slashing the top rates. The reduction would be offset to some extent by eliminating Iowans’ ability to deduct the amount in federal tax income they pay from their state taxes — essentially upping everyone’s Iowa taxes slightly to provide a tax break windfall for the rich.

However, if Republicans wanted to go forward with it this year, it would need to be done with the revenue Iowa already has and not take into account the new federal money from COVID relief. Iowa is set to receive $2.7 billion from the fund.

[inline-ad id=”2″]

Here’s what the American Rescue Plan says on the matter:

“A State or territory shall not use the funds provided under this section or transferred pursuant to section 603(c)(4) to either directly or indirectly offset a reduction in the net tax revenue of such State or territory resulting from a change in law, regulation, or administrative interpretation during the covered period that reduces any tax (by providing for a reduction in a rate, a rebate, a deduction, a credit, or otherwise) or delays the imposition of any tax or tax increase.”

Biden and Democrats’ goals on relief funding have been clear: target help to working families and those who have struggled the most during the pandemic. In addition to the $300/week unemployment increase and the $1,400 direct stimulus payments, the bill also provides for a significant boost to the child tax care credit. Most families will receive $3,600 for children under 6 and $3,000 for children between 6 and 17.

[inline-ad id=”3″]

On a press call today, Iowa Democrats outlined where they hope the federal funding would be appropriated.

“We’re at a time right now where there are so many people that need help that focusing on the tax agenda that they had that was really more focused on folks on the higher end of the distribution, the timing was obviously not right at all, so in terms of the funds that are coming in, we’ve been having a lot of discussion about childcare, about broadband,” Democratic Senate Leader Zach Wahls said. “I would hope that if we were going to be looking at how to use that money that those are the kinds of things that we’d be spending the funds on.”

by Pat Rynard

Posted 3/11/21

Iowa Starting Line is an independently owned progressive news outlet devoted to providing unique, insightful coverage on Iowa news and politics. We need reader support to continue operating — please donate here. Follow us on Twitter and Facebook for more coverage.

[inline-ad id=”3″]

Politics

Biden announces new action to address gun sale loopholes

The Biden administration on Thursday announced new action to crack down on the sale of firearms without background checks and prevent the illegal...

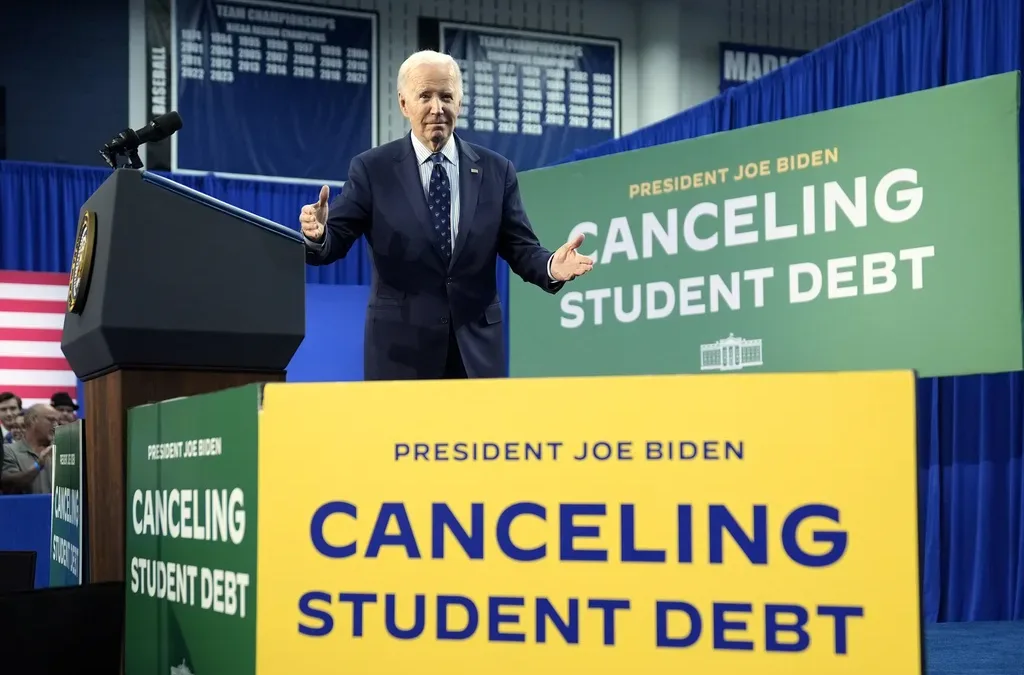

Biden cancels student loan debt for 2,690 more Iowans

The Biden administration on Friday announced its cancellation of an additional $7.4 billion in student debt for 277,000 borrowers, including 2,690...

Local News

No more Kum & Go? New owner Maverik of Utah retiring famous brand

Will Kum & Go have come and gone by next year? One new report claims that's the plan by the store's new owners. The Iowa-based convenience store...

Here’s a recap of the biggest headlines Iowa celebs made In 2023

For these famous Iowans, 2023 was a year of controversy, career highlights, and full-circle moments. Here’s how 2023 went for the following Iowans:...