If you’ve listened to Rep. Ashley Hinson lately, you’d think that under a new proposal, every time you pay your rent, buy a new TV or computer, or otherwise spend at least $600, a notification will pop up on the screen of an IRS employee tracking your every move.

“There’s a new Democrat proposal to allow the IRS to basically monitor transactions of $600 or more,” Hinson said a town hall forum in Maquoketa on Monday. “…I also see this just as an unprecedented invasion of privacy and government overreach … I don’t think they need to know when you’re going to be spending $600 at the grocery store or $600 on your rent or $600 on a utility payment … I think it’s a government spying scheme at its worst.”

She added that she’d already heard from some who went to their bank to withdraw their money “because they didn’t want the government knowing everything that they’re spending.”

But there’s a problem with Hinson’s claims: the way she’s framing it is a wild exaggeration.

[inline-ad id=”2″]

The proposed tax rule would require banks to report the total, aggregate amount of money going into and out of certain bank accounts for a total year. The original proposal targets accounts with at least $600, but Democrats yesterday (after Hinson made her Monday comments) decided to raise the threshold to $10,000.

The proposal doesn’t require reporting individual transactions or what people buy, which Hinson both implies and outright states, only the broad picture of cash flow in bank accounts every year, reported once a year.

This reporting proposal would cut down on tax evasion, according to officials at the US Department of the Treasury. Estimates from the IRS show a gap of $166 billion per year in taxes owed by businesses (excluding large corporations) and the taxes actually paid.

Fact-checking done by USA Today attributes the claim to an InfoWars story published on Oct. 10, which accused the Treasury Department of saying the IRS will monitor transactions, not explaining that aggregate inflow and outflow are not the same as transactions.

“While the claim is based in reality, it gets many of the facts wrong,” USA Today noted. “The claim’s assertion is a proposal by the Biden administration, not a decision set in stone. The Treasury cannot ‘declare’ any changes to law, as that is a legislative power that belongs to Congress. And even if the proposal is adopted banks would not provide access to individual transactions, just the total amount flowing in and out of an account annually.”

Why does the IRS need access to every single bank transaction of $600? They don’t.

That’s why I introduced the Protecting Financial Privacy Act to stop the IRS from monitoring your bank account. pic.twitter.com/EKFG6DIJeM

— Ashley Hinson (@RepAshleyHinson) October 13, 2021

“Currently the IRS has no knowledge about whether taxpayers who earn income in hard-to-track ways are making good on their annual tax obligations,” wrote Deputy Assistant Secretary for Economic Policy Natasha Sarin in a post on the Treasury Department’s website that explains the proposal.

[inline-ad id=”1″]

The post explains that most American workers pay the appropriate amount of taxes, but it’s not true for those who don’t fill out W-2 forms.

“High-income earners, however, often accrue business or pass-through income that is not reported by a third-party to the IRS, so taxes are less likely to be appropriately paid,” Sarin argued. “That is a large part of the reason why, in 2019, the top 1 percent of earners in the United States were responsible for an estimated $163 billion in unpaid taxes.”

The Treasury Department clarified that banks would provide just another piece of data in what they already turnover to the IRS. This additional information will increase the odds of detecting tax evasion and put additional scrutiny on the people who are in a position to underreport.

Any additional IRS scrutiny will be focused on the high end of the income earners, where it belongs—that’s who is driving the tax gap.

Audit rates will not rise relative to recent years for taxpayers making less than $400,000 per year.— Treasury Department (@USTreasury) October 14, 2021

Still, those details have not kept Hinson from also tweeting this misleading, exaggerated information to her 12,100 followers.

The IRS has no business knowing when you spend $600.

This will allow the IRS to target working families across America. I’m fighting against this unprecedented government invasion of your privacy. #IA01 pic.twitter.com/S1j3StWvTc

— Ashley Hinson (@RepAshleyHinson) October 14, 2021

US Sen. Joni Ernst of Iowa has also tweeted about it.

If you make a transaction over $600, President Biden & Washington Democrats want the IRS to know about it.

Instead of combing through Iowans’ bank accounts, it’s time for Democrats to pump the brakes on their reckless tax-and-spending spree. https://t.co/HQbrMvCpEU— Joni Ernst (@SenJoniErnst) October 17, 2021

But there are potential issues with the proposal, including those that don’t require making exaggerated, false claims.

[inline-ad id=”3″]

Director of Government Affairs for the Iowa Credit Union League Gracie Brandsgard said their organization has some concerns about how a policy like this would impact trust and relationships with credit union members.

“There are a lot of people right now who don’t have a lot of trust in institutions, in the government and there are a lot of folks that are un-banked across the country but in Iowa too,” she said.

If those individuals knew more information was being reported, Brandsgard said it could make it harder to build a relationship with them and make them comfortable working with the credit union.

There are potential obstacles to enforcing this rule change, including the IRS being understaffed and working with outdated technology. But how to implement the proposal can be worked out with Congress as it’s debated.

“That additional appropriation to the IRS to help them increase their staffing and get a hold of some additional resources to be able to do the work that’s already on their plate, I think that’s a good start,” Brandsgard said.

In a press conference yesterday, U.S. Senate Finance Committee Chairman Ron Wyden told reporters, “This is about wealthy business owners at the tippy top of the top. That’s where the unpaid taxes are.”

by Nikoel Hytrek

10/18/21

[inline-ad id=”0″]

Politics

AEAs cutting workers in wake of Republican legislation

Iowa legislators said a new bill cutting money for agencies that help students with disabilities wouldn't affect services. But area education...

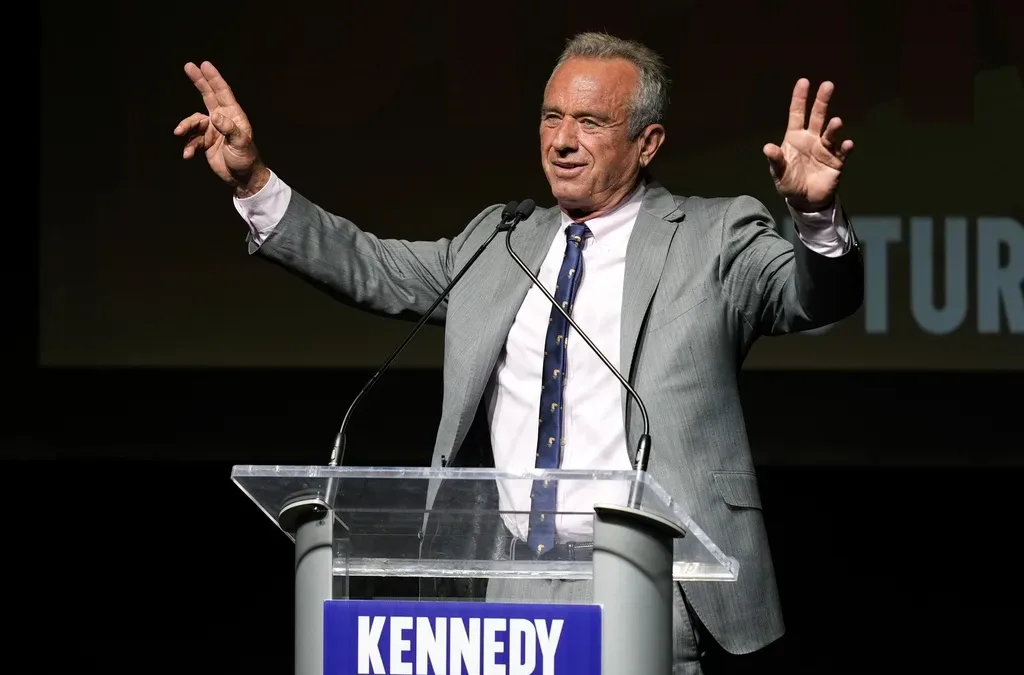

He said what? 10 things to know about RFK Jr.

The Kennedy family has long been considered “Democratic royalty.” But Robert F. Kennedy, Jr.—son of Robert F. Kennedy, who was assassinated while...

Local News

No more Kum & Go? New owner Maverik of Utah retiring famous brand

Will Kum & Go have come and gone by next year? One new report claims that's the plan by the store's new owners. The Iowa-based convenience store...

Here’s a recap of the biggest headlines Iowa celebs made In 2023

For these famous Iowans, 2023 was a year of controversy, career highlights, and full-circle moments. Here’s how 2023 went for the following Iowans:...