Rockwell Collins, one of Iowa’s largest corporations with over $5.26 billion in sales, paid no Iowa income tax in 2017. However, because of an out-of-control state Research Tax Credit program, Rockwell Collins received a check from Iowa taxpayers for nearly $14 million dollars in 2017. Rockwell Collins is just one of 29 of Iowa’s largest companies that paid no Iowa income taxes in 2017. Iowa taxpayers subsidized these companies with $66 million in massive corporate welfare research tax credits. Over $36 million of that total was paid to companies that paid no income tax in 2017.

Governor Reynolds and the Republican-controlled legislature have created a budget crisis for the state of Iowa. They have turned a $900 million surplus into a $250 million deficit and are now cutting state services that Iowans depend upon. They are not only cutting current services but are proposing massive new tax cuts.

Why are Republicans cutting education funding, risking human health services, closing courthouses and jeopardizing correctional officer’s safety in order to fund corporate welfare? In addition to Rockwell Collins, John Deere Corporation received $7.6 million refunds and John Deere Construction received another $3.9 million even though they paid no state income taxes. Green Plains Inc., an ethanol producer, had the third-highest corporate refunds of $5.3 million. How can Republicans justify handing out this massive corporate welfare to profitable companies that pay no Iowa income taxes? Republicans are allowing Iowa taxpayers to get fleeced by huge, profitable corporations that don’t need these corporate welfare payments.

Since 2009, the Iowa Department of Revenue data shows these 29 companies received $375.4 million in Research Tax Credits. The majority of these credits, totaling $301 million, was paid to corporations and individuals that paid no Iowa state income tax. This $301 million was paid to 29 of the state’s largest companies including $96.2 million to John Deere, $91.2 million to Rockwell Collins and $50.4 million to DuPont.

Don’t these huge corporations have a responsibility to pay their fair share of income tax to support our state? The state provides all the public services such as roads, infrastructure, fire and police protection, education and health and human services. These corporations benefit from all these public services and they have a civic responsibility to reduce this unfair burden on Iowa taxpayers.

Iowa is an outlier on these monstrous corporate welfare subsidies. A few other states offer these tax incentives, but they cap the subsidies so that companies can’t escape paying a reasonable amount of their tax liability. Democrats like Sen. Joe Bolkcom, D-Iowa City are calling for reform of these irresponsible tax giveaways.

“The state budget is in freefall right now, and one of the reasons is these bloated tax giveaways,” Bolkcom said. “We’re not going to right the ship here without serious reforms of this tax credit. The total value of all of Iowa’s tax credits has ballooned by 180 percent since 2005, from $153 million to an expected $427 million in 2018, according to a Des Moines Register analysis. As Iowans, we tend to be a frugal lot of folks. And this credit just flies in the face of any kind of conservative, tight-with-the-dollar approach. Bank robbers rob banks because that’s where the money is. And if you want to reform tax credits, you go to where the big spending is. And this one is ripe for reform.”

Bolkcom doesn’t want to eliminate all tax credits, but wants to see reasonable caps on the program. He said Iowa’s Research Tax Credit is far too generous.

The nonpartisan Iowa Policy Project (IPP) has been analyzing these credits for years. Mike Owen, executive director of IPP is calling for reform as well.

“This reckless giveaway goes on year after year — just like Iowa’s shortchanging of public schools and human services, which is related,” Owen said. “This is one place where the state could find revenue to better meet needs, but there appears to be no interest from the Governor or legislative leaders to reform the program.”

“Which of these subsidies pay off for the state taxpayers? We don’t know — but we do know that the program is very costly, and getting more costly, and the vast majority goes to very large, very profitable corporations that would do research anyway, with or without a subsidy,” he added.

Republicans intent on further slashing of taxes and imposing draconian budget cuts must first consider reforming the runaway corporate welfare tax credits.

by Rick Smith

Posted 2/22/18

Politics

AEAs cutting workers in wake of Republican legislation

Iowa legislators said a new bill cutting money for agencies that help students with disabilities wouldn't affect services. But area education...

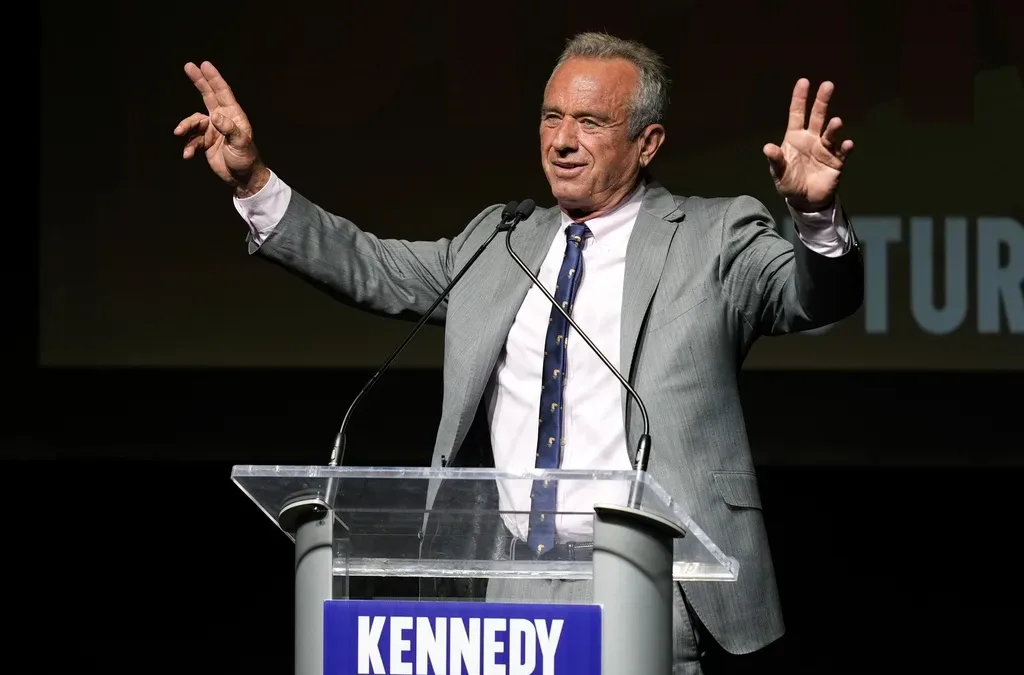

He said what? 10 things to know about RFK Jr.

The Kennedy family has long been considered “Democratic royalty.” But Robert F. Kennedy, Jr.—son of Robert F. Kennedy, who was assassinated while...

Local News

No more Kum & Go? New owner Maverik of Utah retiring famous brand

Will Kum & Go have come and gone by next year? One new report claims that's the plan by the store's new owners. The Iowa-based convenience store...

Here’s a recap of the biggest headlines Iowa celebs made In 2023

For these famous Iowans, 2023 was a year of controversy, career highlights, and full-circle moments. Here’s how 2023 went for the following Iowans:...