Over the last week or so I’ve been paying a lot of attention to the arguments lobbed in support and opposition to the Governor’s proposal for state-funded K-12 ESAs. It wouldn’t be news to Starting Line readers that there is a lot to worry about, particularly the deceptive, overgeneralized, and just plain untrue arguments manufactured by state GOP and uncritically repeated by residents in their social circles and on Nextdoor. (I’m not sure about y’all but my neighborhood network has been blowing up.)

In a profession like mine, it’s hard to know where to start when everything is so egregiously out of line, but when I think about the portion of the argument people seem most confident in repeating, I see a path for school advocates to make some headway.

Reynolds’ argument is simple on its face: the state sends roughly $7,500 per student to public schools; why not increase students’ and families’ choices by allowing them to take $7,500 to whichever school they choose, including private/charter schools? It seems rational, especially in a political/economic climate when people already feel pressed by rising costs and stagnant wages. Reynolds’ proposal offers the promise of greater control over your “own” money (that is collected by the state in the form of taxes).

[inline-ad id=”0″]

But here’s the thing: it’s misleading to directly attach that $7,500 figure to the idea of a single student or a single taxpayer. Misleading, because: whether a family has one child, no children, or ten children, their tax contribution doesn’t change much, right? This $7,500 is simply a way to estimate the taxpayer portion of the per-student expenditure at the state level, but no one single taxpayer is contributing this amount; like every other tax-funded service, the cost is shared across multiple revenue streams, local taxpayers being only one such stream.

So, just as a childless person can’t “opt out” of school funding in order to lower their property tax, a family of school-aged children who wants those children to attend parochial school, can’t “opt out” of the portion of their tax that is earmarked for public schools. That’s not how taxes work. It’s not a buffet!

It is the state’s duty to fund its public schools, just as it is the state’s duty to maintain roads, treat water and waste, and fund a variety of other services that contribute to a functioning society. A state funds those services with taxes (revenue), and individual taxpayers express a preference for how those taxes are collected and apportioned when they vote. That $7,500 figure is not “the student’s” money or “the taxpayer’s” money. In fact, if $7,500 from every taxpayer funded our schools, there would be a lot more money in that pot! But that’s not how the figure is determined.[1]

[inline-ad id=”1″]

Importantly–and this is the thing I think we aren’t talking about enough: the vast majority of a district’s operating costs—such as payroll, property/building maintenance/tax/payments, transportation and security, curricular materials, utilities, and debt service–are fixed, to the extent that they can’t be trimmed or cut on the fly. When a family with one child or four children removes their student(s) from their local district and enrolls them in the private school across town, they aren’t simply reducing the local public school’s costs by $7,500 per student removed—net zero–they are reducing the total operating budget for the district.

GOP elected officials are defending themselves in constituent correspondence, saying for every child that moves into a private school in the district, that district’s public schools will receive $1,200. They say this like it is a good thing, like it is “new money” to the district, assuming, I think, people won’t use their brains. It may be “new” in the sense that currently, no such kickback is offered, but make no mistake, this is nothing but a severance payment: under this proposal, when a student leaves their local public school for a private school, the district will incur a net loss of about $6,300 ($7,500 minus the returned $1,200). (I’m working in round numbers for ease of reading–the actual figures are a bit less tidy.)

[inline-ad id=”2″]

Under this plan if a district loses just 30-40[2] students in a year, but is still obligated to provide the same curriculum, the same programs, the same standards of cleanliness and safety, etc., there will simply be less money to cover the same expenses as were present when those students enrolled: $189,000-$252,000 fewer dollars, in fact, based on the arithmetic above.

Moreover, those public dollars are now being siphoned into private and charter schools that are not obligated by state and federal oversight to provide the same standard of education, the same equity of access as the public schools. It’s difficult to pinpoint what a loss of that size represents in a district–your local superintendents could give you a better idea–but think about the things your local school district does best, the things your kids or your neighbors’ kids love the most.

Imagine all the resources that contribute to the success of those programs–personnel, equipment, materials, maybe transportation, maybe uniforms, etc. Now imagine a non-negligible sized hole in the budget. What gets cut first? And what costs are simply passed on to families?

[inline-ad id=”3″]

When Reynolds and her party insist that all they are doing is allowing parents to have a choice of where their education dollars are spent, they are relying on a low understanding of and low interest in how taxes work. More to the point, they are deliberately misleading voters by framing the funding as if an education can be purchased off the shelf and refunded in thirty days no questions asked.

Though it’s difficult to know the full financial impact of the proposal given the new rules allowing it to bypass Ways and Means, the figure most folks have confirmed is $341 million/year by year three (when it is fully rolled out), climbing to a cumulative total of nearly a billion dollars by year four. This, on top of years of budget-tightening already. To understand more about the funding situation, I reached out to my colleague Dr. Drew Westberg[3], an economist. He dug into the state’s education spending data for me, and here’s what he found:

In general, Gov. Branstad stayed ahead of inflation; Gov. Reynolds has not. The Branstad Administration added roughly $40/student[4] of real additional spending on Iowa students by the end of the 2017-2018 academic year. Governor Reynolds’s Administration lost all of those gains – and then some – in just her first two years in office (2018-2019 and 2019-2020 school years).

[inline-ad id=”5″]

In those two years – a pre-COVID and low-inflation period – real education spending per student fell by $75, taking inflation-adjusted per pupil spending in the State of Iowa back to 2014. Her administration did increase purchasing power substantially for the 2020-2021 school year – the first school year after the start of the pandemic.

The real (i.e. inflation adjusted) story of public education in Iowa is this: Over the last six years (including the last school year under a Branstad budget), school districts have seen their real spending power decline in 4 of those 6 years. Since the start of the 2017-2018 school year, those school districts appear to have lost over $400 in real purchasing power per student. Without question, school district administrators, teachers, staff, students, and parents are being asked to do much more with a whole lot less.

As we continue to ask our school districts to do more with less, the districts with the least will suffer most. Here’s what will happen: rural/sparsely populated communities will see their local schools close or be consolidated while charter and private schools move into the most competitive markets (see the recent dive into these specifics from Starting Line’s Ty Rushing). Arts programs will be cut. Then athletics. Then librarians, school nurses, counselors. Superintendents will need to cull their teaching staff, either eliminating positions altogether or replacing senior teachers (who have decades of experience and institutional knowledge) with lower-salaried novice teachers, who themselves will face larger class sizes (due to position eliminations), reduction of support and safety resources, and reduction of outlets (like athletics and arts) for young people to channel their energy and nurture their interests. Rates of depression and other mental health struggles in children will surge.

[inline-ad id=”6″]

If they can, families will move to the next nearest town, or to nearby states. Without strong local schools, property values will fall. That nest egg known as home equity won’t seem so reliable. Unable to retain quality labor force, larger businesses/employers will close/relocate, leaving layoffs in their wake.

This thing is moving fast but it is not too late; remember that the close of session last year was delayed by weeks because the chambers couldn’t come together on this issue. Keep the pressure, share this column with your neighbors, talk to your school administrators about how your own schools would be impacted, and call your reps TODAY–especially if you live in a red district.

Strong public schools are the bedrock of strong communities. They would be a bargain at twice the price. This is a domino Iowans should fight like hell to protect.

by Allison Carr

1/23/23

[inline-ad id=”0″]

If you enjoy stories like these, make sure to sign up for Iowa Starting Line’s main newsletter and/or our working class-focused Worker’s Almanac newsletter.

To contact Senior Editor Ty Rushing for tips or story ideas, email him at [email protected] or find him on social media @Rushthewriter

Iowa Starting Line is part of an independent news network and focuses on how state and national decisions impact Iowans’ daily lives. We rely on your financial support to keep our stories free for all to read. You can contribute to us here. Also follow us on Facebook and Twitter.

[1] If you really want to get in the weeds, your local school districts publish budget reports annually; I looked up the FY 2020 report for Iowa City Community School District, which states that for individual property owners, just $14.79 per thousand dollars of property valuation goes to the schools; so, at that rate, a home valued at $250k contributes about $3,700 to the schools–half of the per-student rate the state estimates. Amazingly, though ICCSD was at that time the fifth largest district in the state in enrollments, it ranked 237 out of 327 districts statewide in tax rate. The highest per-capita rate was Perry CSD at $20.80 per $1,000 of valuation, and the lowest was LuVerne at just $8.13 per $1,000 of valuation.

[2] Random numbers for illustration purposes only. For a more realistic point of comparison, the FY2020 budget report for ICCSD reports that while “169.2 students from other districts were educated in ICCSD, […] 363 students left the District. This net difference of 193.8 students cost the District $1,333,344 in tuition out payments. Since the inception of the Open Enrollment legislation, the District has paid out $21.7 million more than has been taken in.”

[3] HUGE thanks to Drew for helping me understand the complexity of school funding and for crunching the numbers.

[4] There are approximately 486,000 students enrolled in Iowa public schools

Iowa Republicans make outlawing gay marriage key 2024 campaign priority

Iowa Republicans have made outlawing gay marriage a key goal in their 2024 party platform. During the Iowa GOP’s 2024 state convention on Saturday,...

Department of Justice says Iowa immigration law violates US Constitution

If Iowa doesn’t suspend the enforcement of its new immigration law by May 7, the state could face a federal lawsuit, according to the Des Moines...

Rushing: Iowa State president said the quiet part out loud

I want to thank Iowa State University President Wendy Wintersteen for doing us all a favor by finally saying the quiet part out loud: all the...

Iowa sets aside almost $180 million for year two of voucher program

Iowa has committed nearly $180 million in taxpayer funds to support private school tuition in the 2024-25 school year, which is almost $50 million...

Kalbach: Immediate action needed on corporate ag pollution

Iowa agriculture has undergone substantial changes over the past 40 years. We see it all around us. Rather than crops and livestock being raised on...

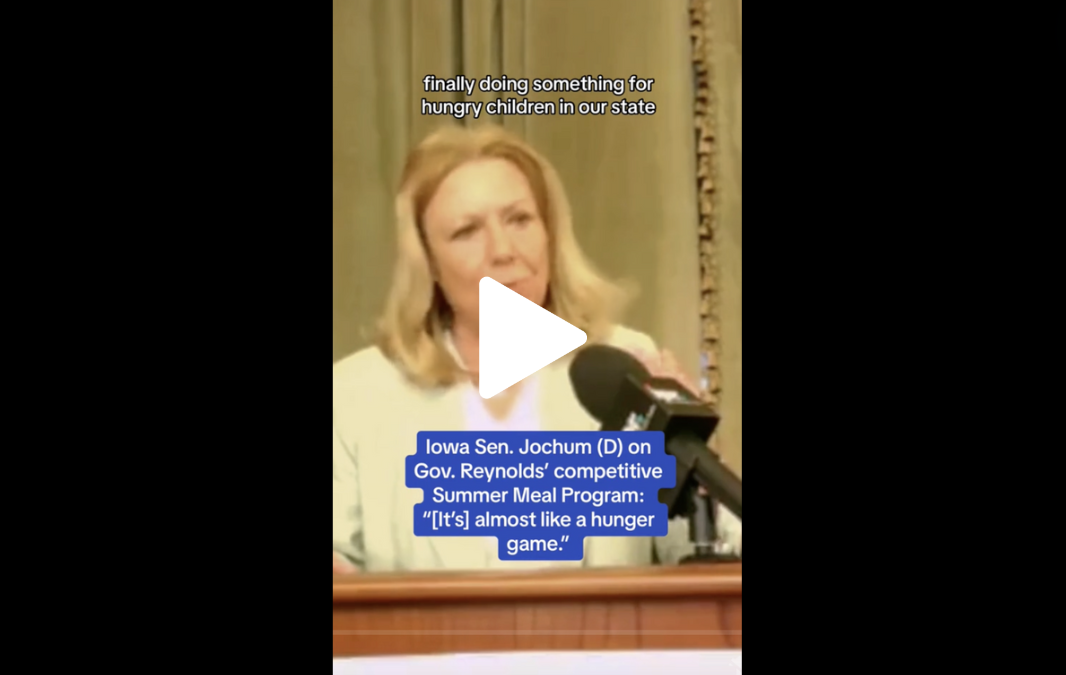

VIDEO: Jochum calls Gov. Reynolds’ summer meal program a ‘hunger game’

Iowa Gov. Reynolds announced a competitive $900,000 grant program to feed Iowa children over the summer, months after she declined $29 million in...