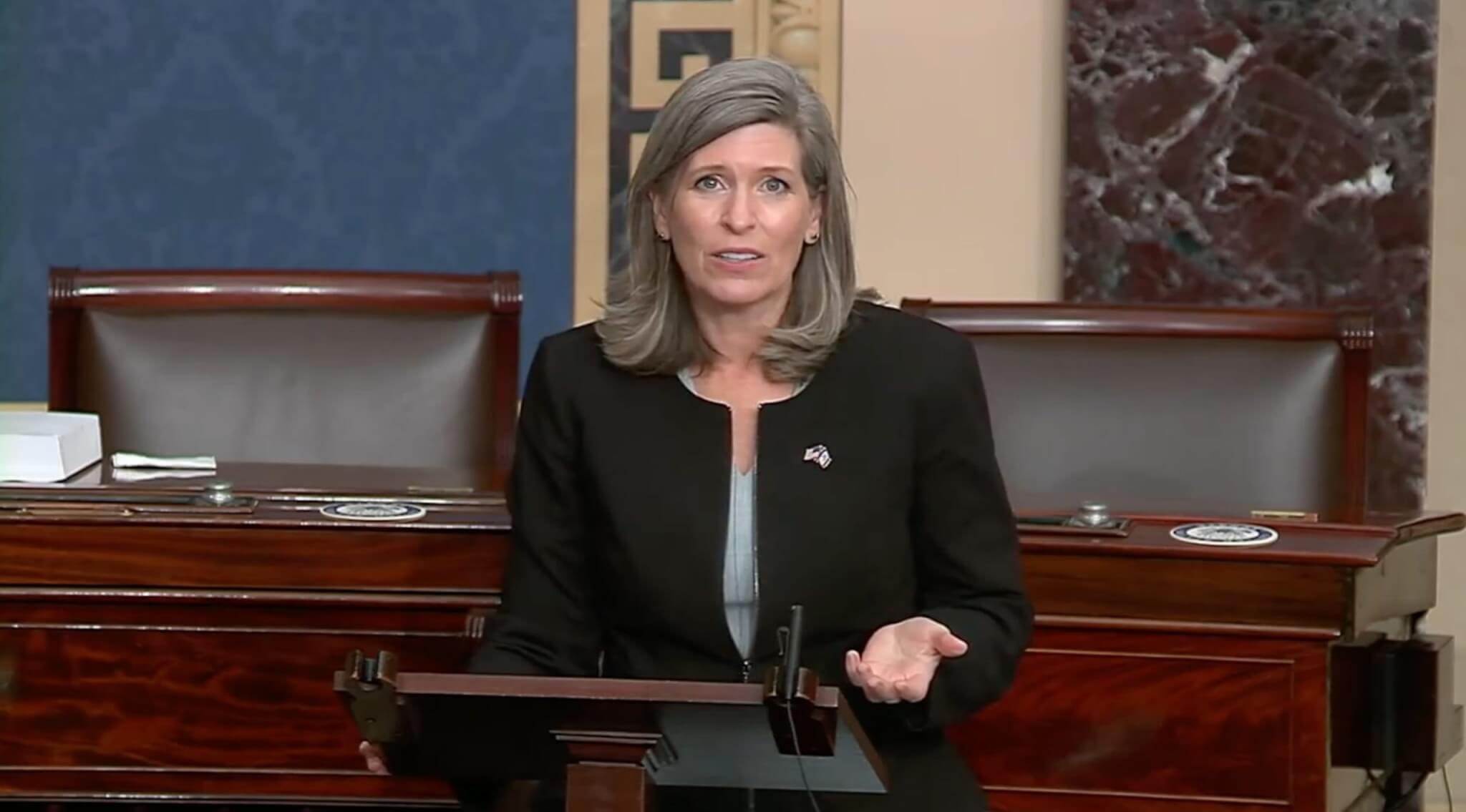

Iowa Sen. Joni Ernst for months has championed federal tax relief for workers most impacted by the coronavirus pandemic. But as Senate Republicans rolled out their coronavirus relief legislation Monday, Ernst’s proposal was not included, in part due to the impact a decrease in taxes would have on Social Security and the federal deficit.

Ernst’s FRNT LINE Act, introduced one week ago, suspends federal income taxes for “essential workers” up to an annual income cap. The bill also halts federal payroll taxes (Social Security and Medicare) for essential workers earning up to $50,000 annually.

“We certainly want to reward those folks that keep America up and moving,” Ernst said last Tuesday at a press conference.

[inline-ad id=”3″]

President Donald Trump also has advocated for a payroll tax cut to be included in the next phase of coronavirus relief, but the idea did not have broad support among Republicans and was unpopular with Democrats.

The Democrats have stated strongly that they won’t approve a Payroll Tax Cut (too bad!). It would be great for workers. The Republicans, therefore, didn’t want to ask for it. Dems, as usual, are hurting the working men and women of our Country!

— Donald J. Trump (@realDonaldTrump) July 23, 2020

Sen. Chuck Grassley told reporters last week he does not support a payroll tax cut because it would amount to little extra money in Americans’ paychecks and could be seen as undermining the Social Security Trust Fund.

“They’re going to see a little bit of money,” Grassley said, according to the Des Moines Register. “Are they going to spend it? Some people will. Some people won’t even notice they’re getting it, if they’re getting a lot of overtime or different hours that they’re working.”

[inline-ad id=”2″]

Critics of Ernst’s proposal point to her past remarks on Social Security reform, particularly the “sit down behind closed doors” comment from a year ago. Even her paid family leave proposal involved Social Security because she wants parents to be able to withdraw a portion of their Social Security funds in order to take time off work to care for their children.

“Point blank, Iowans cannot trust Sen. Ernst to safeguard Social Security, and they’re ready to elect a new senator who will,” said Iowa Democratic Party spokesperson Jeremy Busch.

Instead of a payroll tax cut, Republicans’ HEALS Act proposes another round of $1,200 direct payments to individuals and $200 per week in extra unemployment insurance, down from the current $600.

[inline-ad id=”4″]

Forbes recently laid out several reasons why politicians and financial experts are wary of a payroll tax cut, including the negative impact on Social Security and Medicare; outsized benefits for higher wage earners; small returns for taxpayers; and the fact it does not help retirees or the unemployed.

Sen. John Cornyn, R-Texas, called a payroll tax cut “problematic.”

“I think it’s problematic because, obviously, the trust funds for Social Security and Medicare are already on their way to insolvency,” Cornyn said. “I’m not a fan.”

By Elizabeth Meyer

Posted 7/28/20

Iowa Starting Line is an independently-owned progressive news outlet devoted to providing unique, insightful coverage on Iowa news and politics. We need reader support to continue operating — please donate here. Follow us on Twitter and Facebook for more coverage.

Lanon Baccam wins 3rd District Dem primary, will face Zach Nunn

Baccam defeats Melissa Vine to challenge Republican incumbent Lanon Baccam defeated Melissa Vine in Tuesday’s Democratic primary for Iowa’s 3rd...

Hardin County man running for office as Trump-loving Democrat to local party’s dismay

Brad Rewoldt, who recently changed his party affiliation from Republican, says his support of Trump will probably 'piss off' Democrats There is a...

Scheetz: Tax cuts for all Iowans, not just the wealthy

State Rep. Sami Scheetz says all Iowans should benefit from tax cuts via a sales tax reduction As a state representative, my job is to serve the...

Kalbach: What Iowa Republicans focused on during legislative session

Our state legislative session finished up towards the end of April, and I’m glad it’s over! From further de-funding and privatizing our public...

Advocates file suit to stop Iowa’s ‘unconstitutional’ immigration law

Immigration advocates filed a federal lawsuit Thursday to stop Iowa’s new immigration law—SF 2340—from taking effect arguing that the legislation...

Iowa Republicans make outlawing gay marriage key 2024 campaign priority

Iowa Republicans have made outlawing gay marriage a key goal in their 2024 party platform. During the Iowa GOP’s 2024 state convention on Saturday,...