As small towns across the country struggle to attract or retain businesses, the USDA has been awarding a number of rural development grants to help stimulate growth.

“I just feel like there’s been a reinvigorated interest in rural issues and communities, and seeing that manifest itself in different ways has been really encouraging,” said Grant Menke, the Iowa State Director of USDA Rural Development. “Iowa is pretty much the best in the nation at the rural economic development program.”

Decorah, Iowa, took advantage of one over a decade ago that helped develop their now-lively commerce and arts scene in town. Fayette, Iowa, where ten local businesses closed in 2014, recently put a grant to use to revitalize their downtown, with hopes of achieving similar results.

“Access to equity is often a big challenge for small businesses in small towns. [These grants] do not compete with rural banks, rather they help finance a gap that exists between what a business can get from a financial institution and the cost of the project they’re working on,” explained Bill Menner, former Iowa State Director of USDA Rural Development and current Executive Director of the Iowa Rural Development Council. “So, it’s a supplement to bank loans, not a way to replace the bank.”

But with the Trump Administration’s efforts to cut the USDA’s budget, grants like these, which fall under the discretionary portion of the budget, could be limited if the trend continues.

Rural Business Development Grants

One of the USDA grants Menner is referring to is the Rural Business Development Grant (RBDG), which awards between $10,000 and $500,000 for training, technical assistance and other uses, “leading to the development or expansion of small and emerging private businesses in rural areas which will employ 50 or fewer new employees,” the grant’s page says.

“I think people sometimes get the misunderstanding that if it’s a business grant, it must be free money for businesses, and in fact that’s not typically the case,” Menner said. “Typically, it’s going to a government or a non-profit that is somehow building capacity for businesses.”

The RBDGs are awarded to towns, communities, state agencies, authorities, non-profit corporations, higher-education institutions, federally-recognized tribes and rural cooperatives. This provides the recipient group the chance to create a collection from which they can lend to small businesses, who will pay back into said collection. These are known as “revolving funds,” and small towns in Iowa have been taking advantage.

“In a perfect world, the revolving loan fund can be self-sustaining. So, the small business who is getting the loan is repaying it with maybe a little bit of interest, and as those dollars flow back in, new loans can be made as the dollars revolve,” Menner explained. “So, it doesn’t just disappear – good revolving loan funds can continue on for infinity, theoretically.”

Decorah, Iowa

As small towns have struggled over the last decade, Decorah, with a population of around 7,700, has set their own path, creating a vibrant local economy and a thriving arts scene. While they are aided by the presence of Luther College, a liberal arts school that is their biggest employer, they have also been investing in rural development for some time, Sam Whitehead of the Upper Explorerland Regional Planning Commission, told Starting Line.

Even as far back as far as 2010, Decorah has held the strongest retail market for towns in the surrounding area. Taking advantage of opportunities to invest in historic infrastructure and their local art scene, their visitor website is now able to promote their art scene, local festivals, museums, entertainment, wineries, outdoor activities and their music scene.

“Many of these businesses may have nothing to do with agriculture, but the fact that they exist in a small town creates a vibrant economy in those small towns that help them succeed and, at the end of the day, serve the farmers around them,” Menner said.

The Upper Explorerland Revolving Loan Fund (RLF) and Intermediary Relending Program (IRP), both of which provide financing to new and expanding businesses, are parts of this USDA lending venture. Decorah now has their own RLF, as do Fayette and Fayette County.

[inline-ad id=”0″]

Fayette, Iowa

Within the last year, Fayette, Iowa, with a population around 1,500, received an RBDG from the USDA worth $99,000. To kick-start their revolving fund, the city also pitched $100,000 of their own money to match the grant. With this fund, small businesses can apply for low-interest loans (1-5 percent) between $5,000 and $50,000.

After seeing ten downtown businesses close their doors during a brief stint around 2014, Mayor Andrew Wenthe decided they needed to be “more aggressive” to recruit or help out new businesses.

Despite being just a 45 minute drive away from Decorah, Fayette’s economy is on the opposite end of the spectrum as Decorah. With a population one-fifth the size, Fayette’s consumer markets are not as strong as that of Decorah.

Wenthe told KCRG in August, “Statewide, we are seeing population move from rural communities to urban communities, and that’s an issue that myself as mayor and everybody in our community wants to help address.”

“The program that [Fayette] used is really geared toward establishing a revolving loan-fund, and there are other programs you can then use to supplement an existing revolving loan fund,” Menner said. “There’s value in investing in taking steps to support rural communities, but if rural communities are left on their own to compete with big cities to compete for all these funds, they don’t have the capacity or the staff or the ability to write all the grants and make all the applications that big cities have.”

Surviving the Trump Administration

During Donald Trump’s presidency, there have been consistent attempts to cut the USDA’s budget, including the discretionary spending, which RBDGs fall under. As the graph below shows, the USDA budget was proposed to drop off by $32 billion in just the first two years of the Trump administration, though the actual spending ended up dropping by just $21 billion – still a wide margin.

The proposed budget for 2020 shows a $6 billion increase from 2019, though 2019 spending will not be officially totaled for some time. Despite the increase over the last year, USDA proposed spending is still down nearly $20 billion, $4 billion of which comes from discretionary spending.

“If you think about USDA rural development, it really acts as an infrastructure bank for small towns,” Menner said. “Congress, many years ago, decided there was value in supporting rural communities, because that’s where farmers go for shopping, healthcare, education, and off-farm income. Without those small towns, there was fear among members of Congress and past administrations that agriculture might fail.”

But with limited money already on the table, the funds available for the high-impact grants could be threatened if the trend continues of cutting USDA funding. Iowa is only allotted $200,000 to $500,000 per year in small business grants, Menner said. So, Fayette’s $99,000 grant could be near, or over, 1/5th of all the money available.

“But then, if you start doing the extrapolating of the impact on the community if you have a small business that’s successful, and you create this revolving loan fund, that can help seed future small businesses – the impact of that little bit of grant money can go a long way,” Menner said.

These grants have the potential to have a profound impact on the communities they are awarded to, especially with the growth potential of a revolving loan fund. While presidential candidates have been talking a lot of rural issues, and connecting with rural voters, the USDA’s budget has not factored in heavily to the discussion.

by Josh Cook

Posted 6/20/19

Iowa Republicans make outlawing gay marriage key 2024 campaign priority

Iowa Republicans have made outlawing gay marriage a key goal in their 2024 party platform. During the Iowa GOP’s 2024 state convention on Saturday,...

Department of Justice says Iowa immigration law violates US Constitution

If Iowa doesn’t suspend the enforcement of its new immigration law by May 7, the state could face a federal lawsuit, according to the Des Moines...

Rushing: Iowa State president said the quiet part out loud

I want to thank Iowa State University President Wendy Wintersteen for doing us all a favor by finally saying the quiet part out loud: all the...

Iowa sets aside almost $180 million for year two of voucher program

Iowa has committed nearly $180 million in taxpayer funds to support private school tuition in the 2024-25 school year, which is almost $50 million...

Kalbach: Immediate action needed on corporate ag pollution

Iowa agriculture has undergone substantial changes over the past 40 years. We see it all around us. Rather than crops and livestock being raised on...

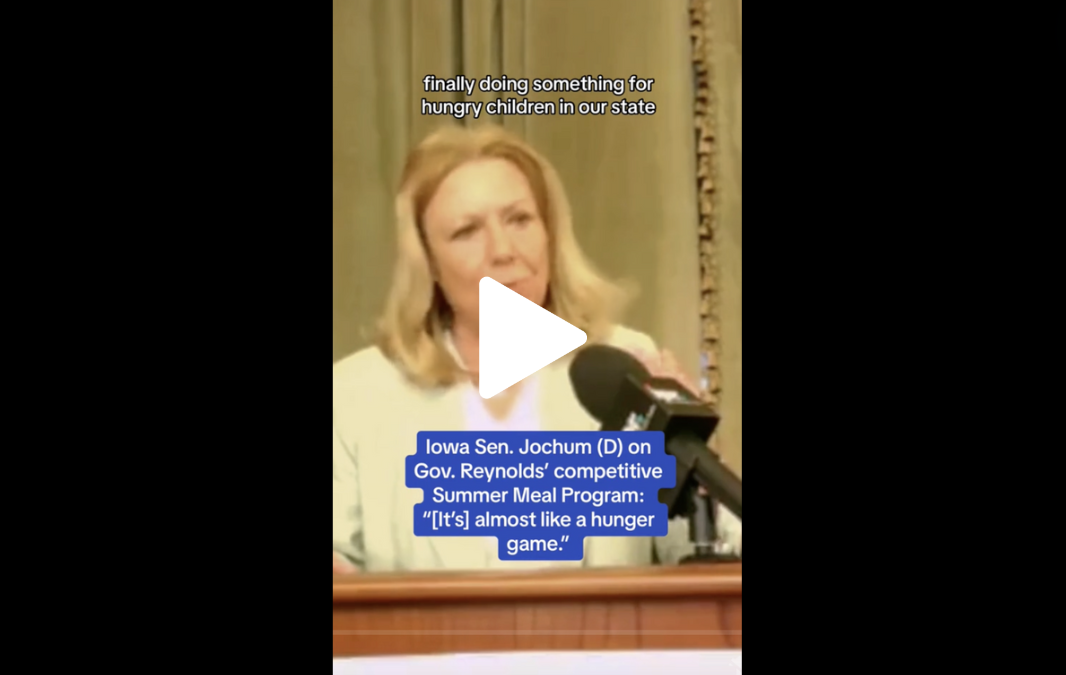

VIDEO: Jochum calls Gov. Reynolds’ summer meal program a ‘hunger game’

Iowa Gov. Reynolds announced a competitive $900,000 grant program to feed Iowa children over the summer, months after she declined $29 million in...