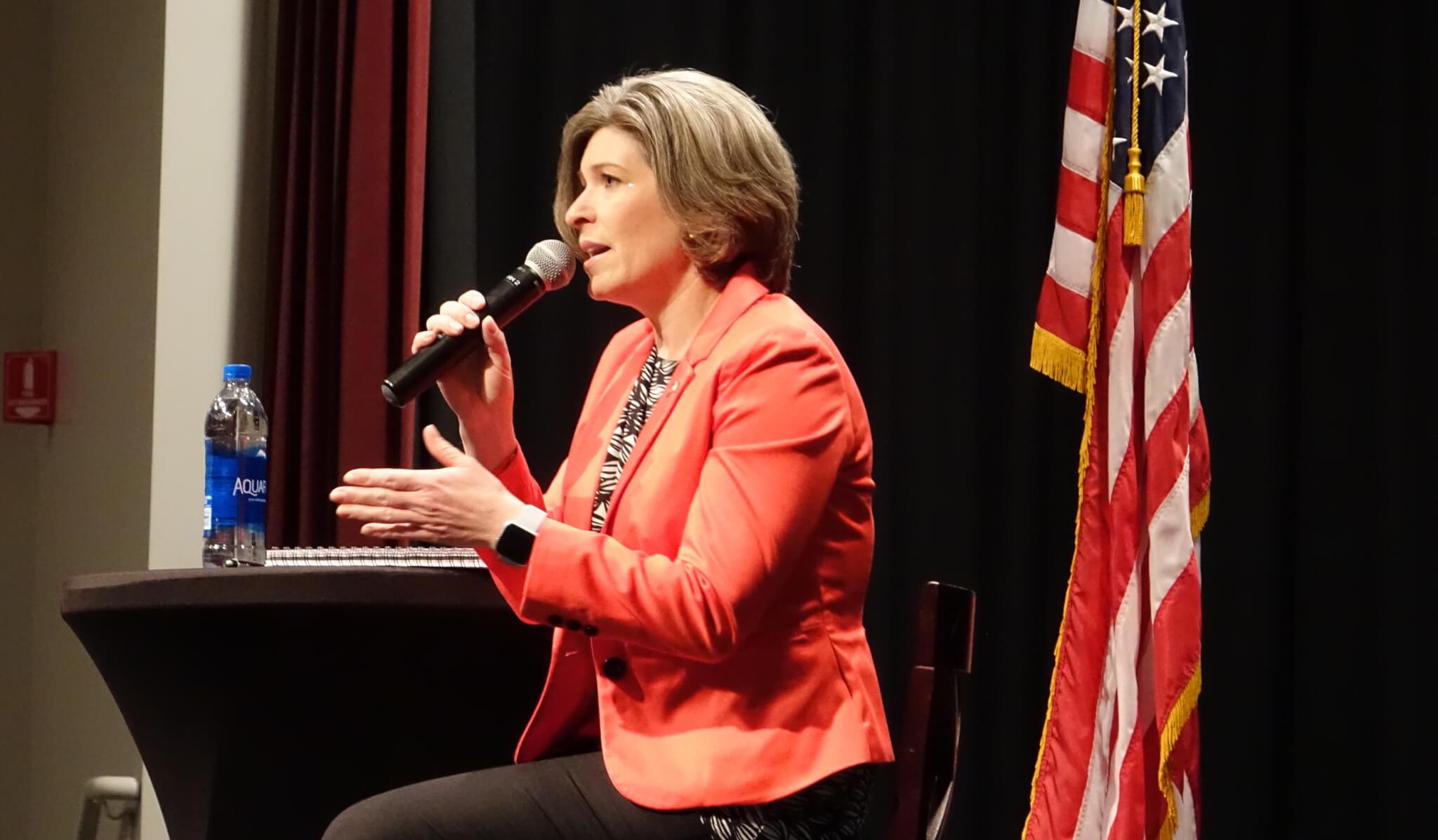

Senator Joni Ernst seemed to suggest today that a major driver of high student loan debt is students borrowing more than they need in order to spend it on personal costs. She related a story about a college friend spending his loan money on his girlfriend’s rent as an example of the problem facing indebted students.

While at one of her town hall forums in Davenport this morning, Ernst was asked by a single mother what she planned to do about college affordability.

“What are you actively doing to reduce the cost and the interest rates to be able to go to college without high-interest rate student loans?” the woman, whose daughter wanted to be a marine biologist, asked.

Ernst began by talking about Pell Grants.

“We have the Pell Grant structure – supportive of the Pell Grants for those that will qualify,” Ernst replied. “Other types of grants that exist, as well, we want to be supportive of those to make sure that those dollars are available to those that need them.”

[inline-ad id=”0″]

She added that she was open to finding a way to let people renegotiate the interest rates of their student loans.

“Making sure that perhaps we have a way of renegotiating some of those loans, when you see a lower interest rate to take advantage of that opportunity,” she said.

Then Ernst turned to what she saw as a problem that students were causing for themselves.

“What we see is a lot of young people are borrowing more than what they need for their education. I’ll give an example of when I was going to school at Iowa State,” Ernst said. “A friend of mine, we had received checks in the mail for student loans. When he received his student loan check, he said, ‘Oh great, Joni, I got my student loan check in the mail, now I can go pay my girlfriend’s rent.’ Okay, that’s not what the student loan is for.”

“So, making sure that those students understand – don’t borrow more than what your education will cost, and use it for your education,” she continued. “For those books that you need, a way of living in the meantime, certainly. But don’t borrow more than you have to.”

[inline-ad id=”2″]

Many studies point to skyrocketing college tuition costs and the inability for aid packages to keep up as a key driver in the nation’s student debt crisis. That’s led to a situation where the total student loan debt in America rose from $345 billion in 2004 to $1.4 trillion in 2017.

“We really do need to better educate, but then having access to low-interest loans will be important, and, as you said, making sure there’s enough Pell Grants,” Ernst concluded.

College tuition costs have also obviously increased significantly since Ernst was enrolled. When Ernst graduated from Iowa State University in 1992, the average in-state tuition was $2,072 (about $3,500 in today’s dollars). Most sites put the cost at just under $9,000 now. The average cost of a four-year education has more than doubled in Iowa since the early 1990s.

by Pat Rynard

Photo by Julie Fleming

Posted 4/26/19

Lanon Baccam wins 3rd District Dem primary, will face Zach Nunn

Baccam defeats Melissa Vine to challenge Republican incumbent Lanon Baccam defeated Melissa Vine in Tuesday’s Democratic primary for Iowa’s 3rd...

Hardin County man running for office as Trump-loving Democrat to local party’s dismay

Brad Rewoldt, who recently changed his party affiliation from Republican, says his support of Trump will probably 'piss off' Democrats There is a...

Scheetz: Tax cuts for all Iowans, not just the wealthy

State Rep. Sami Scheetz says all Iowans should benefit from tax cuts via a sales tax reduction As a state representative, my job is to serve the...

Kalbach: What Iowa Republicans focused on during legislative session

Our state legislative session finished up towards the end of April, and I’m glad it’s over! From further de-funding and privatizing our public...

Advocates file suit to stop Iowa’s ‘unconstitutional’ immigration law

Immigration advocates filed a federal lawsuit Thursday to stop Iowa’s new immigration law—SF 2340—from taking effect arguing that the legislation...

Iowa Republicans make outlawing gay marriage key 2024 campaign priority

Iowa Republicans have made outlawing gay marriage a key goal in their 2024 party platform. During the Iowa GOP’s 2024 state convention on Saturday,...