Iowa Republicans’ tax negotiations continue shrouded in secrecy without input from Democrats or major stakeholders. They are ramming their reckless tax changes forward with an Iowa farm economy that is already distressed. If President Trump pushes his agriculture-killing tariffs forward, the Iowa economy could crater.

In February the USDA released their annual net farm income forecast. The USDA predicts farm income will decrease by $4.3 billion (6.7%). “That would be the lowest net farm income level in nominal dollars since 2006.” Add some Trump tariffs on and Iowa’s farm economy (and tax revenues) could crash and burn.

Iowa could easily see tax revenues drop as they did during the farm crisis of the 1980s. In that event, a tax cut would magnify the depth of a farm depression. This is no time to embark on a foolish, unproven tax cut experiment on Iowa’s economy.

Republicans love to claim they believe in transparency in government, but they are cooking up their tax scheme hidden from the public. Why are they proposing to make massive changes to Iowa’s tax code behind closed doors?

Why are Republicans hiding their tax scheme from the public until the final days of this year’s legislative session? Why are they ignoring the dangerous warnings of a declining farm economy? Why are they piling more tax cuts on wealthy Iowans that just received a huge federal tax cut windfall?

We certainly have a clue to their planned tax changes from the one feature they are publicly promoting. They’re planning to cut tax revenues by adding the Qualified Income Business Deduction (QIBD) to the Iowa State tax code. That change will cut Iowa’s business tax by mimicking the federal tax scam passed by the U.S. House and Senate. Like the federal tax cuts, the Iowa tax cuts will give huge tax cuts to the wealthiest Iowans. Both the Iowa Republicans’ House and Senate versions contain the QIBD although at different rates.

This special business deduction would exempt up to 20% of income for certain business owners: subchapter S corporations, limited partnerships or sole proprietorships. This deduction applies to so called “pass-through” income as opposed to salaried income. The Iowa Fiscal Partnership (IFP) in their recent policy statement, Yet Another Loophole for Iowa, identifies the major beneficiaries are the wealthiest Iowans.

“Higher-income taxpayers benefit the most. At the federal level, for example, more than half of all pass-through business income belongs to the top 1 percent of tax filers, and the deduction costs the federal government about $50 billion a year. In Iowa, it’s estimated that 79 percent of the financial benefit would fall to the richest 5 percent of all households at a cost to the state treasury of more than $100 million per year,” according to the IFP.

Democrats have warned that the Republican tax cut plan closely resembles the 2012 Republican Kansas tax experiment that failed miserably. In June 2017 the Kansas legislature repealed their pass-through QIBD deduction. Kansas raised taxes in a clear admission that their supply-side tax cuts destroyed their state budget. The Kansas tax cutting experiment created havoc in funding for Kansas schools and government services.

Iowa Republicans are justifying the QIBD proposal using the same unproven claims that Kansas used to sell their failed tax plan. Kansas Republicans predicted the additional windfall profits that business owners accrued from this deduction would be used to grow the economy. The fact that Kansas was forced to repeal their tax deduction after 5 years should serve as a cautionary tale to Iowans.

Democrats have seen this Iowa Republican movie before. Last year the Republican legislators used the same playbook when they hid their plan to demolish collective bargaining. They promised they were just going to tweak collective bargaining; then they sprung their destructive plan to strip collective bargaining rights from public employees.

The Iowa Republicans’ massive tax cuts would be a risk in normal economic times. Cutting Iowa tax revenue with unneeded tax cuts to the richest Iowans in these fragile economic times is fiscally irresponsible.

by Rick Smith

Posted 4/27/18

Iowa Republicans make outlawing gay marriage key 2024 campaign priority

Iowa Republicans have made outlawing gay marriage a key goal in their 2024 party platform. During the Iowa GOP’s 2024 state convention on Saturday,...

Department of Justice says Iowa immigration law violates US Constitution

If Iowa doesn’t suspend the enforcement of its new immigration law by May 7, the state could face a federal lawsuit, according to the Des Moines...

Rushing: Iowa State president said the quiet part out loud

I want to thank Iowa State University President Wendy Wintersteen for doing us all a favor by finally saying the quiet part out loud: all the...

Iowa sets aside almost $180 million for year two of voucher program

Iowa has committed nearly $180 million in taxpayer funds to support private school tuition in the 2024-25 school year, which is almost $50 million...

Kalbach: Immediate action needed on corporate ag pollution

Iowa agriculture has undergone substantial changes over the past 40 years. We see it all around us. Rather than crops and livestock being raised on...

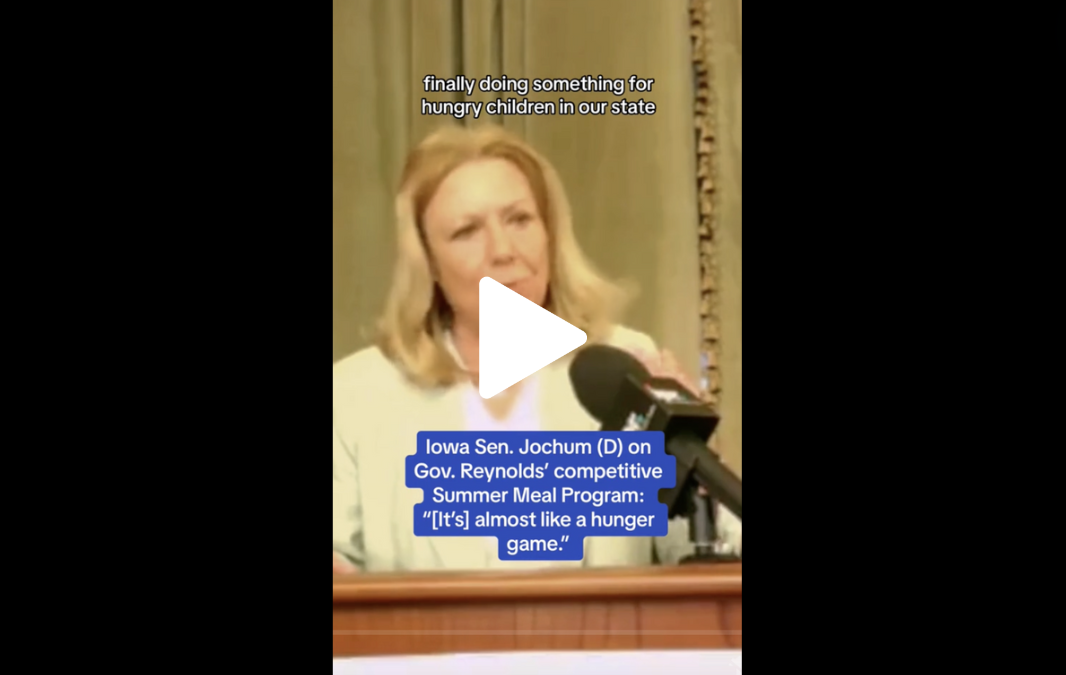

VIDEO: Jochum calls Gov. Reynolds’ summer meal program a ‘hunger game’

Iowa Gov. Reynolds announced a competitive $900,000 grant program to feed Iowa children over the summer, months after she declined $29 million in...