This long-awaited national Republican tax cut plan is nothing more than the recycling of Reagan’s failed “trickle-down economics” tax cut plan. Also known as supply side economics, President George H.W. Bush called it “voodoo” economics. The premise of Reaganomics was based on tax cuts for the rich that moved massive amounts of cash to those at the top while taking it from the bottom. The thoroughly repudiated theory promised big tax cuts for the richest Americans would stimulate economic growth.

David Stockman, President Reagan’s Budget Director, once the champion of Reagnomics now admits, “ Reaganomics … Supply Side Economics and tax cuts for the rich … failed massively!”

Stockman now says that Larrry Kudlow, one of Trump’s chief supply side advocates, “was dead wrong as chief economist at OMB in 1981 when he claimed that big tax cuts would cause an immediate boom and be self-financing.” Stockman points to the huge deficits created by the Reagan tax cuts that required tax increases in subsequent years.

A new report by the Institute on Taxation and Economic Policy (ITEP) provides an analysis of the Trump Administration and the Congressional Republicans’ proposed tax cuts. The tax cuts will vary from state to state, but nationally two-thirds (67 percent) of the tax cuts would go to the richest one percent of Americans in 2018. These are the wealthiest taxpayers that have an average income of nearly $1.2 million. The Republicans are defending their proposed tax cuts for the richest Americans by claiming that it will stimulate economic growth.

A number of tax policy groups are weighing in on the Republican tax cut plan. Seth Hanlon, a senior fellow at the Center for American Progress, says, “I think what we’re seeing is massive tax cuts for millionaires and billionaires,” Hanlon says, “and mystery meat for the middle class.”

Mike Owen of the Iowa Fiscal Partnership (IFP) says half of the tax cuts would go to the top one percent of rich Iowans. “Under that analysis those tax cuts to the top one percent (of Iowans) would average $50,000 per household in 2018 alone,” Owen says.

IFP’s analysis shows Iowans would receive $1.5 billion in total tax cuts and the one percenters would get 50% of that total. The bottom 60 percent of taxpayers would receive less than 15 percent of the total reduction.

ITEP estimates 186,000 middle class Iowa households will actually pay more in taxes under the Republicans’ plan. That fact alone contradicts the Republicans’ claim that middle class taxpayers will benefit from their plan.

The Republicans’ proposed repeal of the estate tax underscores how their plan will significantly increase income inequality. Only two-tenths of 1 percent of Iowa estates (70 in Iowa) are projected to face any estate tax in 2018. The estate tax only applies to estates valued above $5.5 million per individual and $11 million for a couple. The estate tax serves an important leveling effect that redistributes wealth and reduces economic disparity. In addition, nationally it produces a significant $269 billion in essential government revenue over 10 years.

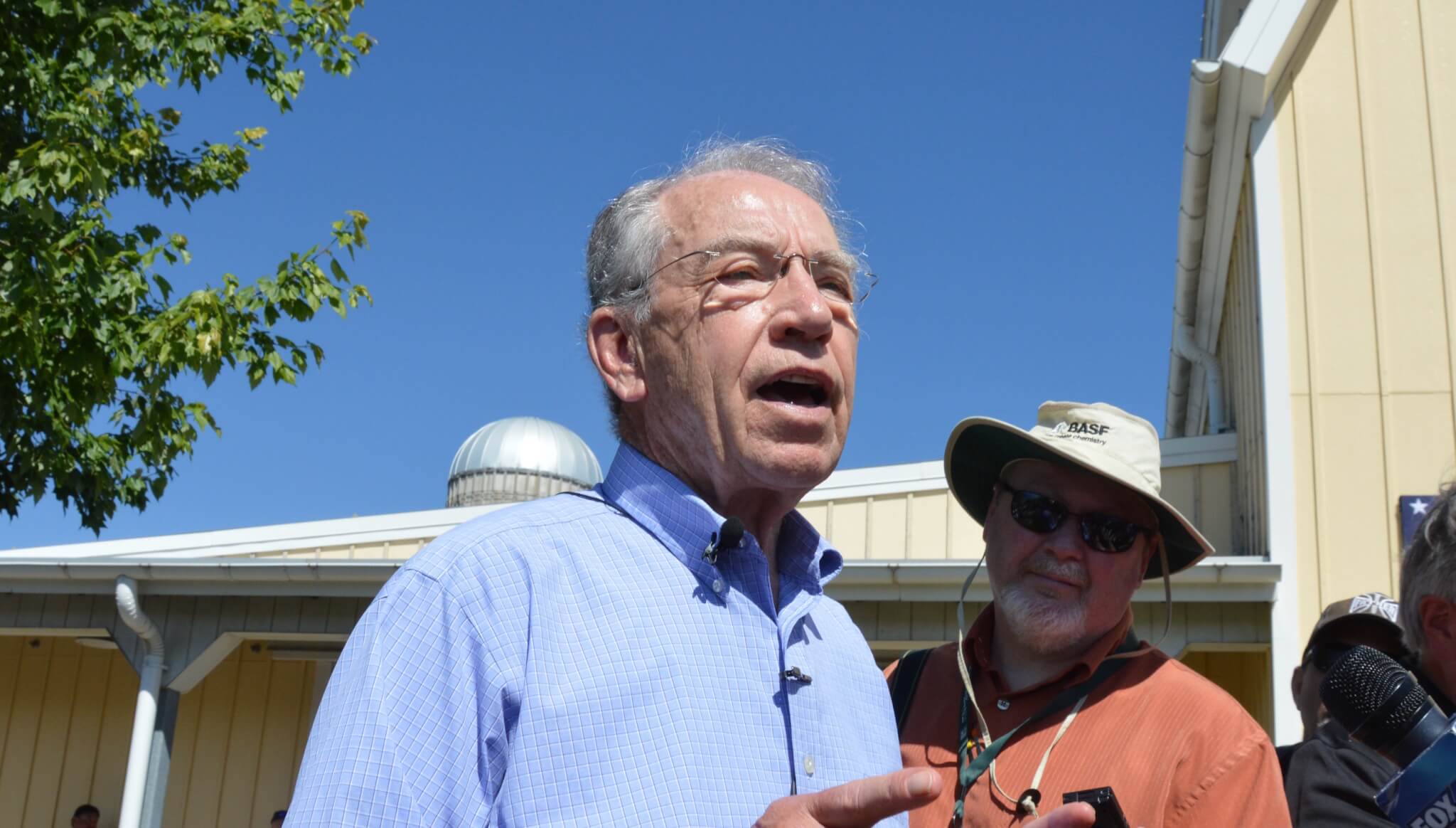

The Senate Budget Committee voted yesterday to advance their tax cut plan. The vote was along party line votes with Senator Grassley voting with the Republican majority.

Democrats successfully stopped the Trumpcare bill. Stopping the Republicans’ tax cuts for millionaires and billionaires is the next big test for Democrats.

by Rick Smith

Posted 10/6/17

Big corporations are suing to block Biden’s efforts to lower costs

From the cost of medication to education to everyday expenses, the Biden administration has passed several laws and implemented many federal rules...

Iowa Republicans make outlawing gay marriage key 2024 campaign priority

Iowa Republicans have made outlawing gay marriage a key goal in their 2024 party platform. During the Iowa GOP’s 2024 state convention on Saturday,...

Department of Justice says Iowa immigration law violates US Constitution

If Iowa doesn’t suspend the enforcement of its new immigration law by May 7, the state could face a federal lawsuit, according to the Des Moines...

Rushing: Iowa State president said the quiet part out loud

I want to thank Iowa State University President Wendy Wintersteen for doing us all a favor by finally saying the quiet part out loud: all the...

Iowa sets aside almost $180 million for year two of voucher program

Iowa has committed nearly $180 million in taxpayer funds to support private school tuition in the 2024-25 school year, which is almost $50 million...

Kalbach: Immediate action needed on corporate ag pollution

Iowa agriculture has undergone substantial changes over the past 40 years. We see it all around us. Rather than crops and livestock being raised on...