Internal Revenue Service (IRS) Commissioner Danny Werfel speaks during a House Committee on Appropriations Subcommittee on Financial Services and General Government hearing on Capitol Hill, Tuesday, May 7, 2024, in Washington. (AP Photo/Mark Schiefelbein)

The IRS’ Direct File program was rolled out on a limited basis in 12 states this past tax-filing season and saved 140,000 taxpayers who used it an estimated $5.6 million in filing costs. Now, the agency is looking to expand it nationwide.

Paying to file your taxes may soon be a thing of the past for many Americans.

The Internal Revenue Service (IRS) announced Thursday that its experimental Direct File free tax-filing option will become a permanent option for American taxpayers and will be offered in all 50 states starting in the 2025 tax filing season.

For filers who are subject to state income taxes, their states must opt in to Direct File for them to be able to use it.

The IRS pilot program is currently designed for filers with fairly simple tax returns–like W2s or Social Security income–and who take the standard deduction. Freelancers, or those who rely on gig work, were not eligible this past year. IRS Commissioner Daniel Werfel said that the agency is looking to expand eligibility to all taxpayers over time, however.

Direct File was rolled out on a limited basis in 12 states this past tax-filing season—Arizona, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming, Massachusetts, California and New York—and the agency saw 140,000 taxpayers claim more than $90 million in refunds and save an estimated $5.6 million in filing costs, according to a press release issued in conjunction with the US Treasury Department.

“President Biden is committed to saving Americans time and money and ensuring families receive the tax benefits they’re owed. Providing a free tool to all Americans who want the option to file directly with the IRS is key to achieving those goals,” Treasury Secretary Janet Yellen said in a statement.

Taxpayer advocates have long called for a program to reduce or eliminate the cost of filing and President Biden’s 2022 Inflation Reduction Act required the IRS to study the potential for a free, agency-run direct filing system. After reviewing the report, which showed significant taxpayer interest in a free filing option, the Treasury Department launched a Direct File pilot for the 2024 filing season.

National Economic Adviser Lael Brainard said that the Biden administration’s “investment in modernizing the IRS is already paying off, and we’re looking forward to this resource being available to more Americans across the country.”

Meanwhile, large tax filing companies, such as TurboTax parent company Intuit, have claimed that a program like Direct File is a waste of taxpayer resources—though, they’re far from neutral observers.

Those large companies stand to lose millions if Direct File is more widely used. According to the Associated Press, in 2022 alone, more than 60 million taxpayers were serviced between Intuit and H&R Block. Those companies and others have spent tens of millions of dollars trying to influence lawmakers on the issue, according to lobbying data.

Republican attorneys general in 12 states have echoed similar concerns, expressing opposition to Direct File, suggesting their states might opt out of participating next year.

Sick of hidden fees on concert tickets and hotel stays? A new federal rule bans them.

Now, live event businesses and hotels must clearly list their prices in both their advertising and pricing information. American consumers on...

Trump’s economic plans would worsen inflation, experts say

Mainstream economists warn that Trump's plans to impose huge tariffs on imported goods, deport millions of migrant workers, and demand a voice in...

Harris wants to give working families a tax cut and raise taxes on corporations. Trump would do the opposite.

Kamala Harris has proposed increasing the corporate tax rate, expanding the child tax credit, and cutting taxes for more than 100 million working...

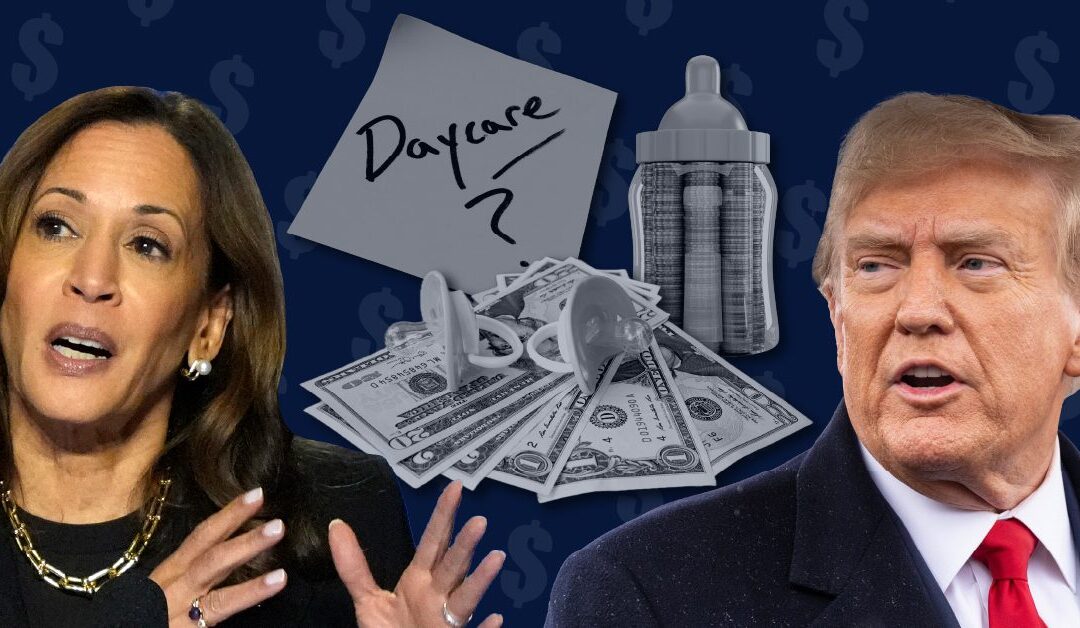

Harris wants to cap child care costs and expand the child tax credit. Trump’s solution? Tariffs.

Harris has proposed capping families’ child care costs to 7% of their income and offering families of newborns up to $6,000 in the first year of the...

Harris wants to lower grocery prices by taking on price gouging. Trump’s plan would increase prices.

Kamala Harris has said that she will call on Congress to pass a federal ban on price gouging and give the federal government more authority to...

Harris’ plans aim to make housing more affordable. Trump’s plans are less clear.

Harris has vowed to increase the available housing supply by three million homes and to provide lower-income first-time homebuyers with up to...