President Joe Biden speaks in the South Court Auditorium on the White House complex in Washington, Thursday, June 15, 2023, to highlight his administration's push to end so-called junk fees that surprise customers. Phil Hutcheon, CEO of DICE, left, Tobi Parks, CEO of xBk, look on. (AP Photo/Susan Walsh)

The Biden administration on Tuesday announced a finalized rule that will cap most credit card late fees at $8, the latest in a series of efforts by the White House to cut down on “junk fees” that saddle middle- and working-class Americans with extra costs.

First proposed in July, the Consumer Protection Bureau (CFPB) estimates that the final regulation will save American families more than $10 billion a year by cutting fees from an average of $32.

“For over a decade, credit card giants have been exploiting a loophole to harvest billions of dollars in junk fees from American consumers,” CFPB Director Rohit Chopra said in a statement. “Today’s rule ends the era of big credit card companies hiding behind the excuse of inflation when they hike fees on borrowers and boost their own bottom lines.”

This rule will apply to “large” credit card issuers – those that have more than one million open accounts, such as American Express, Discover, and Capital One. According to the CFPB, these large issuers represent more than 95% of the total outstanding credit card debt in the United States.

More than 45 million Americans are charged late fees on credit cards each year, according to the CFPB. Those people will now save an average of $220 annually.

This rule also aims to close a loophole that has allowed credit card companies to “exploit” borrowers, the CFPB says, by allowing them to raise fees on borrowers who made late payments.

The CFPB also proposed a rule in January that would curb excessive overdraft fees.

Chuck Bell, advocacy program director at Consumer Reports, described the new rule as a way to make a “real difference.”

“Credit card companies collect billions of dollars in excessive late fees at the expense of economically vulnerable families every year,” he said in a statement. “It’s simply unfair to impose a steep late fee penalty that far exceeds the credit card company’s costs, especially when someone is just a few hours or a couple of days late making their payment.”

The financial industry, on the other hand, slammed the rule, claiming that it will cause more people to pay their bills late, which will in turn damage their credit scores.

The US Chamber of Commerce—one of the largest lobbying groups in the country—has also said that it will “imminently” file a lawsuit against the CFPB to prevent the regulation from taking effect.

The rule is currently scheduled to take effect 60 days after it’s published in the Federal Register, which is expected to happen in a few weeks. Legal challenges to the rule could ultimately delay its implementation, however.

The finalized regulation comes as Americans continue to sink further into credit card debt, which exceeded a record $1.1 trillion last month. It’s also just the latest in the Biden administration’s efforts against the high cost of living heading into the 2024 election.

In October, President Biden proposed a new Federal Trade Commission (FTC) rule that would prohibit companies across the private sector from hiding additional fees by requiring all industries under its jurisdiction to show the full price of an item being purchased to the consumer “up-front,” meaning before they get to checkout.

The administration proposed another regulation last year that would require cable companies and satellite providers to show the full price of their services upfront, as well. The Federal Communications Commission (FCC) also proposed a rule in Nov. 2022 that would require internet companies to publish prices, data allowances, and other important information on “easy-to-understand labels” for consumers as they compare services by the end of 2024.

Sick of hidden fees on concert tickets and hotel stays? A new federal rule bans them.

Now, live event businesses and hotels must clearly list their prices in both their advertising and pricing information. American consumers on...

Cornhole Champions #1 – Recounting the count

Iowa Democrats didn't exactly get points on the board in 2024. But it's not all bad news. Toss the bags with us as we get a temperature check on...

Trump’s economic plans would worsen inflation, experts say

Mainstream economists warn that Trump's plans to impose huge tariffs on imported goods, deport millions of migrant workers, and demand a voice in...

Harris wants to give working families a tax cut and raise taxes on corporations. Trump would do the opposite.

Kamala Harris has proposed increasing the corporate tax rate, expanding the child tax credit, and cutting taxes for more than 100 million working...

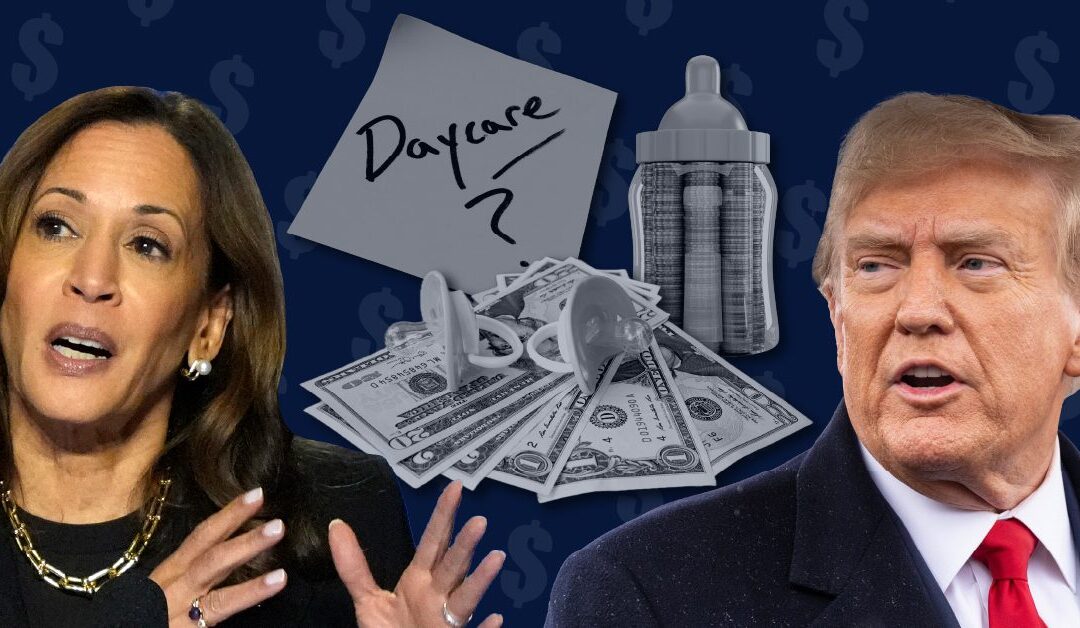

Harris wants to cap child care costs and expand the child tax credit. Trump’s solution? Tariffs.

Harris has proposed capping families’ child care costs to 7% of their income and offering families of newborns up to $6,000 in the first year of the...

Harris wants to lower grocery prices by taking on price gouging. Trump’s plan would increase prices.

Kamala Harris has said that she will call on Congress to pass a federal ban on price gouging and give the federal government more authority to...