House Speaker Kevin McCarthy of Calif., talks to reporters on Feb. 6, 2023, on Capitol Hill in Washington. (AP Photo/Jacquelyn Martin, File)

Speaking at a recreation center in Virginia last week, President Biden asserted that Republican lawmakers could put millions of Americans’ health care at risk if they continue to push for plans that include drastic spending cuts to key programs like Medicaid and the Affordable Care Act (ACA).

Biden, who is set to release his budget plan on Thursday, has pledged to strengthen Medicare and Medicaid and defend Social Security from reductions in spending. He said his goal is to bring down medical costs for families, while also reducing the national debt by $2 trillion over 10 years.

Biden’s remarks come as House Speaker Kevin McCarthy and his fellow congressional Republicans have expressed a desire to cut government spending and reduce the national debt. But some of their plans would actually increase the deficit, and others would decimate programs that tens of millions of Americans rely on.

Here’s a look at what Republican lawmakers have proposed, and what those plans would mean for Americans.

Republicans’ Proposals to Cut Social Security and Medicare

For years, congressional Republicans have repeatedly tried to cut and/or privatize Medicare and Social Security.

For example, Florida Senator Rick Scott spent much of 2022 pushing a plan that would have required Medicare, Medicaid, and Social Security to be reauthorized every five years. This would have put 65 million Medicare and Social Security beneficiaries and more than 80 million Medicaid beneficiaries at risk. Scott walked back his plan last month, after nearly a year of backlash.

[inline-ad id=”0″]

In November, Senate Minority Whip John Thune declared that Social Security and Medicare benefits should be slashed. After winning back control of the House in November, top Republicans in that chamber initially said they planned to use upcoming debt ceiling negotiations to cut spending on the programs by raising the retirement age. Following significant backlash, GOP lawmakers appear to have tentatively backed down from this possibility and shifted their focus to other programs.

Cutting Spending on the Affordable Care Act and Medicaid

Over the past decade, almost every Republican budget proposal has targeted the Affordable Care Act and Medicaid in some way.

While Republicans appear to have finally given up on repealing the ACA, they’re still contemplating ways to cut spending on the program—even if it means making healthcare more expensive for millions of Americans.

As The Washington Post reported last month, Donald Trump’s former budget director, Russell Vought is providing Republican lawmakers with “a seemingly inexhaustible stream of advice,” which includes a 104-page memo that calls for cutting $9 trillion over the next decade from thousands of domestic programs.

Vought’s 10-year budget proposal includes $2 trillion in cuts to Medicaid and more than $600 billion in cuts to the ACA.

[inline-ad id=”1″]

Removing subsidies would cause the cost of health insurance premiums to go up, which could cause people to give up their coverage altogether. The Republicans’ plans for Medicaid would also affect the nation’s most vulnerable.

Seniors and people with disabilities who live at home would receive worse home care and hundreds of thousands of nursing home residents would be at risk of lower quality of care. Millions of people struggling with addiction could lose access to substance use treatment or mental health care and 41 million children who receive coverage through Medicaid or the Children’s Health Insurance Program would also be at risk of losing access to care, or getting worse coverage.

Raising the Price of Prescription Drugs

In February, House Republicans introduced legislation that would repeal President Biden’s Inflation Reduction Act, a move that would raise seniors’ prescription drug prices and raise taxes on an estimated 14.5 million people—all while increasing the deficit.

The Inflation Reduction Act capped the cost of insulin to $35 a month for seniors on Medicare, will cap out-of-pocket spending on prescription drugs to $2,000 a year for Medicare recipients starting in 2025, and requires Medicare to negotiate the cost of 10 high-cost prescription drugs beginning in 2026, reducing their cost.

If the Inflation Reduction Act is repealed, everyone with Medicare would pay higher prices for prescription drugs and millions of American seniors would no longer be able to get recommended vaccines for free. Drug companies could also once again increase drug prices faster than inflation with no accountability, which they did last year for 1,200 prescription drugs.

Notably, repealing the Inflation Reduction Act would also add to the deficit to the tune of $240 billion, according to an analysis from the nonpartisan Congressional Budget Office.

Republicans Take Aim at Food Assistance

Vought’s plan also proposes more than $400 billion in cuts to the Supplemental Nutrition Assistance Program (SNAP), which helps 41 million Americans feed their families every year.

The leader of the House Budget Committee, Republican Rep. Jodey Arrington, also said that SNAP could be a source for potential savings in a cost-cutting memo issued in January.

[inline-ad id=”2″]

SNAP provides lower-income households with an average of $239 each month for groceries. Anti-poverty experts have said that that money is critical to keeping families from going hungry, but Republican lawmakers have consistently argued that “food stamps” cost too much and prevent Americans from joining the workforce.

In reality, SNAP requires all able-bodied adults without dependents to work at least 80 hours a month to be eligible, though requirements vary by state. Republicans have argued that the work requirements should be tougher, even though evidence suggests that most recipients are already working.

A 2018 study found that more than three-quarters of families who receive SNAP benefits had at least one person working and about one-third included two or more workers, a clear indication that many families that rely on government assistance worked.

Cutting IRS Funding and Extending the Trump Tax Cuts

Republicans claim their efforts to cut spending will reduce the national deficit, but they recently voted to add to the deficit by stripping roughly $71 billion from the Internal Revenue Service, targeting funds Democrats approved for the IRS last year as part of the Inflation Reduction Act. These funds are being used to address a wide range of issues, such as improving taxpayer services to quicken agency response times and upgrading its aging computer systems.

A report released by the Congressional Budget Office in January, found that scaling back IRS funds would make it more difficult for the service to collect unpaid taxes, adding about $114 billion to the deficit over the next decade.

[inline-ad id=”3″]

Repealing the new IRS funding would make it easier for millionaires, billionaires, and corporations to “cheat the system,” Vice President Kamala Harris said in a statement.

According to the Committee for a Responsible Federal Budget, cutting funding would also expand the tax gap, the difference between taxes owed to the federal government each year and the amount actually collected. When this difference “expands,” policymakers have to choose between higher deficits, lower spending on important priorities, or tax increases to compensate for lost revenue.

What could send the deficit even higher, however, is an extension of the GOP’s primary policy achievement over the past decade: the 2017 Trump tax cuts.

[inline-ad id=”4″]

A group of more than 70 House Republicans have introduced legislation that would make elements of those tax cuts—which primarily benefited corporations and the super rich—permanent. According to a Congressional Budget Office analysis, this move would also cost around $2.2 trillion through 2032, spiking the national debt. A Tax Policy Center analysis also estimated that the extension would deliver an average tax cut of $175,710 to the richest 0.1%.

“Republicans will cut taxes for the mega-rich and well-connected while holding our economy hostage to force punishing cuts to programs American families rely on,” Democratic Rep. Brendan Boyle of Pennsylvania said last month during an appearance on MSNBC: “That should tell you everything you need to know about Republicans’ priorities.”

by Isabel Soisson

03/07/23

If you enjoy stories like these, make sure to sign up for Iowa Starting Line’s main newsletter and/or our working class-focused Worker’s Almanac newsletter.

To contact Senior Editor Ty Rushing for tips or story ideas, email him at [email protected] or find him on social media @Rushthewriter.

Iowa Starting Line is part of an independent news network and focuses on how state and national decisions impact Iowans’ daily lives. We rely on your financial support to keep our stories free for all to read. You can contribute to us here. Also follow us on Facebook and Twitter.

Politics

Biden announces new action to address gun sale loopholes

The Biden administration on Thursday announced new action to crack down on the sale of firearms without background checks and prevent the illegal...

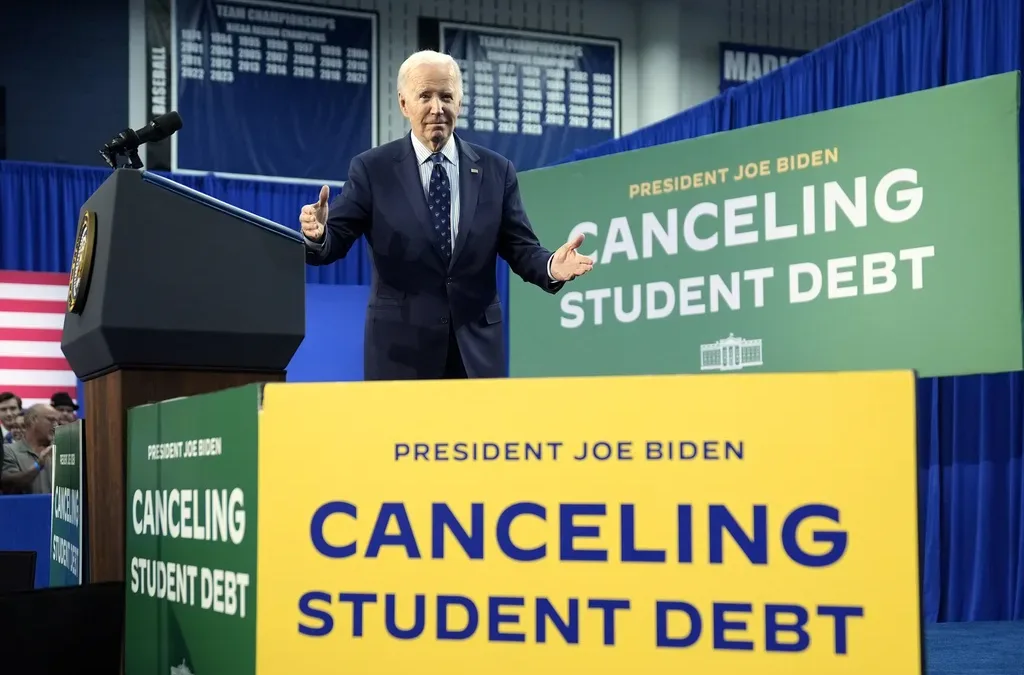

Biden cancels student loan debt for 2,690 more Iowans

The Biden administration on Friday announced its cancellation of an additional $7.4 billion in student debt for 277,000 borrowers, including 2,690...

Local News

No more Kum & Go? New owner Maverik of Utah retiring famous brand

Will Kum & Go have come and gone by next year? One new report claims that's the plan by the store's new owners. The Iowa-based convenience store...

Here’s a recap of the biggest headlines Iowa celebs made In 2023

For these famous Iowans, 2023 was a year of controversy, career highlights, and full-circle moments. Here’s how 2023 went for the following Iowans:...