Maybe you’ve noticed a trend of companies giving shareholders and executives even-bigger piles of money while offering their employees a pittance.

One recent example from Iowa: Case New Holland International (CNHi), which has a plant in Burlington where 440 United Auto Workers members are on strike, noted in late July it had amassed “record consolidated revenues” of $6.082 billion in the second quarter alone. Net income was $552 million for the quarter.

More than 1,000 unionized workers at CNH Industrial (CNHi) in Iowa and Wisconsin, where they manufacture Case and New Holland agricultural products, began striking on May 2. Workers are asking for fair wages, retirement benefits, and better working conditions.

Somehow, record revenues don’t translate into more money for workers.

A whopping $300 million of CNHi’s revenue is going to stock buybacks, a financial move that generally increases value for shareholders only. The company also paid its shareholders $412 million in dividends in May.

[inline-ad id=”0″]

And they’re far from the only ones.

This week, while 122 workers remain on strike in Cedar Rapids, their company Ingredion announced it had authorized a stock buyback of up to 6 million shares by the end of December.

Stock buybacks used to be illegal

Buying back stocks was actually illegal market manipulation until 1982, when the Securities Exchange Commission began allowing it. It accelerated after the Trump Administration’s Tax Cuts and Jobs Act of 2017, which was heavy on the tax cut—a 35% to 21% rate—and, it turned out, not so heavy on the “jobs” part.

Companies like General Motors, Wells Fargo, and JPMorgan Chase laid off hundreds of workers that year despite a combined $3.7 billion windfall from the tax cut.

That money has not translated into better pay or conditions for workers either, Ohio’s Sen. Sherrod Brown wrote in 2019.

“Since the 1980s, corporate America has become increasingly focused on quarterly profits and shareholder value as the two most important metrics of success, and maximizing shareholder value as a company’s primary purpose,” Brown wrote. “As a result, corporate objectives have become increasingly divorced from the interests of workers and communities, and workers are paying the price in layoffs and stagnating wages.”

[inline-ad id=”1″]

Wealth grabbing won’t stop

The company is far from the only one doing stock buybacks.

In 2021, S&P 500 companies bought back a record $881.7 billion in stocks, up nearly 70% from the year before.

“Stock buybacks are virtually unregulated, even though Congress has recognized their potential for market manipulation,” Lenore Palladino, a professor of economics, testified before the House Financial Services Committee in 2019.

Palladino said stock buybacks virtually only enrich the ultra-wealthy: 86.8% of corporate equities that year went to the richest 10%, while the bottom 50% in total own less than 0.8% of the total value of the stock market.

“Meanwhile, companies spending billions on buybacks claim that they cannot afford to pay family-supporting wages to their employees, who largely create the value that allows businesses to conduct stock buybacks in the first place,” Palladino said.

[inline-ad id=”3″]

The practice may be curtailed, at least marginally, beginning next year. The new Inflation Reduction Act put a 1% excise tax on the practice beginning in 2023, which is estimated to raise $74 billion in federal revenue over the next 10 years.

But that also means companies could accelerate stock buybacks through the rest of 2022 since they’re currently tax-free. Even after the tax is put in place, companies could just shift to paying shareholders dividends instead.

“Companies are conducting stock buybacks in the midst of layoffs, calls by their workforce for an end to poverty wages, and clear productive uses for corporate funds,” Palladino said.

She recommended to Congress that they ban or place “bright-line limits” on buybacks, which Congress was loathe to do until 2020, when they temporarily banned the practice in 2020 for companies that received COVID stimulus funds, so that they wouldn’t simply enrich themselves.

That mostly affected airlines, who will see that COVID stock buyback ban lifted on Friday, Sept. 30. Labor unions are now engaged in the anti-buyback fight.

“We can’t allow executives to send one dime to Wall Street before they fix operational issues and conclude contract negotiations that will ensure pay and benefits keep and attract people to aviation jobs,” said Sara Nelson, international president of the Association of Flight Attendants, which represents some 50,000 cabin crew members.

By Amie Rivers

9/27/22

Have a story idea for me? Email amie at iowastartingline.com. I’m also available by text, WhatsApp and Signal at (319) 239-0350, or find me on Twitter, TikTok, Instagram and Facebook.

Iowa Starting Line is part of an independent news network and focuses on how state and national decisions impact Iowans’ daily lives. We rely on your financial support to keep our stories free for all to read. You can contribute to us here. Follow us on TikTok, Instagram, Facebook and Twitter.

[inline-ad id=”4″]

Support Our Cause

Thank you for taking the time to read our work. Before you go, we hope you'll consider supporting our values-driven journalism, which has always strived to make clear what's really at stake for Iowans and our future.

Since day one, our goal here at Iowa Starting Line has always been to empower people across the state with fact-based news and information. We believe that when people are armed with knowledge about what's happening in their local, state, and federal governments—including who is working on their behalf and who is actively trying to block efforts aimed at improving the daily lives of Iowan families—they will be inspired to become civically engaged.

Iowa Republicans make outlawing gay marriage key 2024 campaign priority

Iowa Republicans have made outlawing gay marriage a key goal in their 2024 party platform. During the Iowa GOP’s 2024 state convention on Saturday,...

Department of Justice says Iowa immigration law violates US Constitution

If Iowa doesn’t suspend the enforcement of its new immigration law by May 7, the state could face a federal lawsuit, according to the Des Moines...

Rushing: Iowa State president said the quiet part out loud

I want to thank Iowa State University President Wendy Wintersteen for doing us all a favor by finally saying the quiet part out loud: all the...

Iowa sets aside almost $180 million for year two of voucher program

Iowa has committed nearly $180 million in taxpayer funds to support private school tuition in the 2024-25 school year, which is almost $50 million...

Kalbach: Immediate action needed on corporate ag pollution

Iowa agriculture has undergone substantial changes over the past 40 years. We see it all around us. Rather than crops and livestock being raised on...

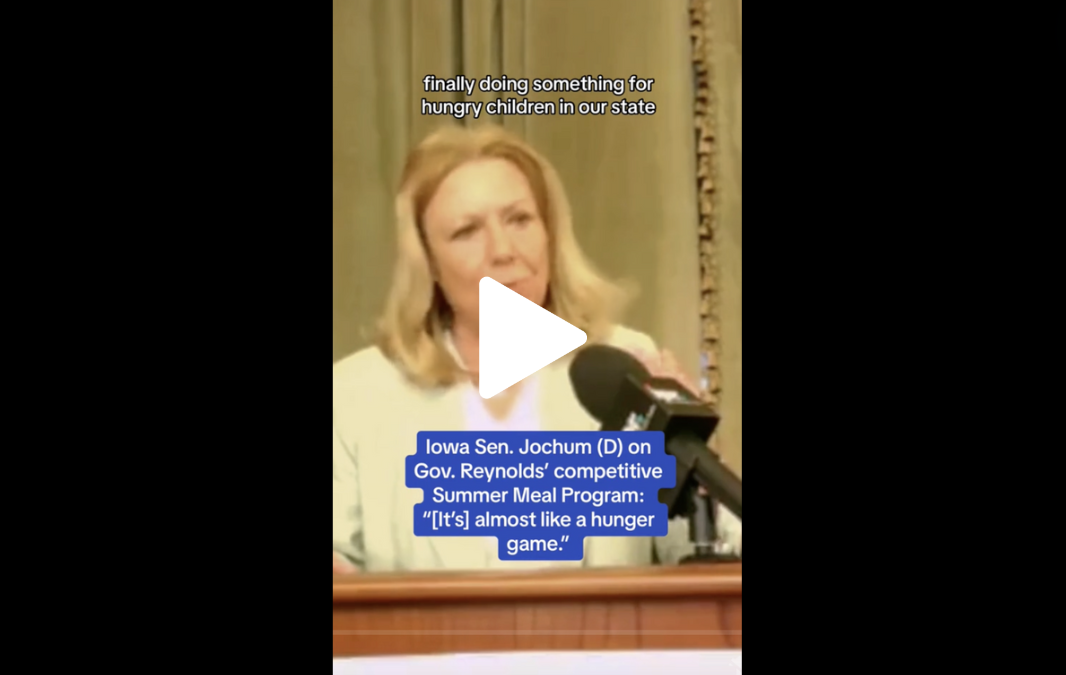

VIDEO: Jochum calls Gov. Reynolds’ summer meal program a ‘hunger game’

Iowa Gov. Reynolds announced a competitive $900,000 grant program to feed Iowa children over the summer, months after she declined $29 million in...