Getty images

Chris Pietropinto knows what it’s like to have to choose between bills.

For the last two decades, the Cedar Rapids woman and her husband have lived on one income, after a disability at 23 meant Pietropinto could no longer work. Instead, she did her best to balance their books.

“He’s worked everything from lube tech to line cook to gas jockey; mostly non-benefit jobs with low pay,” Pietropinto said of her husband’s employment.

In a bygone era, even just one low-paying job might have allowed the couple to get by.

But Iowa’s minimum wage of $7.25 per hour—untouched since the federal government last raised it in 2009—hasn’t kept up with the reality of price increases. The couple dealt with rent hikes, higher food prices and unexpected vehicle maintenance. All the while, Pietropinto tried to figure out ways to make it through another month.

A sick cat one month meant forgoing the electric bill and catching up later. A sore tooth meant waiting for days or even weeks for a spot to open up at the University of Iowa’s student dental clinic—which is cheaper but takes longer, with more hoops to jump through—and swallowing their pride to ask family for the extra cash to pay for it.

“Those ‘extra’ expenses almost broke us down a few times,” she said.

[inline-ad id=”1″]

The Pietropintos usually did not qualify for food assistance, like an estimated one in four food-insecure people that fall through the cracks. Pietropinto still remembers “the scary time” one week, when she cleaned out their fridge and pantry of the last of their food.

She still remembers exactly what went into it: An eighth of a pound, combined, of sausage and bacon. One can of mixed vegetables. One can of refried beans. One cup of rice. Two eggs. A bit of ketchup.

She called her creation “practically meatless meatloaf,” and said she and her husband made it stretch for four days. But there were three more before payday.

“When you live check-to-check for so long, the stress and tension just become normal,” Pietropinto said. “You don’t even recognize it anymore. We were focused on survival.”

[inline-ad id=”2″]

Poverty ‘starting to go back up’

More than 9 million adults employed full-time in the US qualified for the federal Supplemental Nutrition Assistance Program (SNAP), previously known as food stamps, in February of 2020. That was before the pandemic, Russia’s war on Ukraine and more affected everything from the supply chain to inflation.

“Things are costing more money, food is costing more money, gas prices are costing more money. But also, the supply chain isn’t what it was,” said Barb Prather, executive director at the Northeast Iowa Food Bank.

But it’s more than that, Prather said: During the early months of the pandemic, federal and state governments stepped in, pumping more money into programs like nutrition assistance that massively helped lower food insecurity across the country.

But Republican Gov. Kim Reynolds let a COVID disaster proclamation expire in February, which meant those extra benefits expired. Food banks reported as much as 70% increases in demand that they’re barely keeping up with today as food prices continue to rise.

“What we saw over the last two years, as government supports for people were in place, as people went back to work, our numbers were actually lower than pre-COVID,” Prather said. “And now, what we’re seeing again with this cut to SNAP benefits—because the maximum allotment went away, the disaster proclamation went away—is our numbers are starting to go back up again.”

[inline-ad id=”3″]

Living in ‘hell’

Anne Bacon remembers her own six-year period, what she termed “hell,” living on poverty wages with her children.

Even after she started making a living wage—even now, as CEO of IMPACT Community Action Program in central Iowa—it’s still difficult to leave her calculator at home when she goes grocery shopping.

“Knowing how close you are to that edge—that trauma is real, carrying that burden,” Bacon said. “It takes a long time and a lot more money for someone to feel like they’re not at that edge.”

As of the latest ALICE report from United Way in 2018, 37% of Iowans struggled to afford basic household expenses. That’s only gotten worse for Bacon’s clients, particularly after the extra food and child care benefits provided by governments during COVID went away recently.

“We saw … a higher percentage of folks we had never seen before” in the last two years, she said. “That indicates people that have fallen below that ability to meet their basic needs—new people— due to the pandemic and inflation.”

[inline-ad id=”4″]

Evictions on the rise since 2011

Most people incorrectly think home evictions have only been on the rise as of late, when the COVID-era moratorium went away.

But that’s not true, said Alex Kornya, litigation director for Iowa Legal Aid, which helps low-income folks with civil legal cases.

Evictions “have been steadily rising since 2011,” he said, and the problem is directly related to wage stagnation.

“Rent is getting more expensive, and wages aren’t going up,” he said. “That is probably one of the No. 1 issues.”

And it’s not just in urban areas, either: While rent for a typical 2-bedroom apartment has gone up more than a quarter statewide in the last two years, nine out of 10 counties with the highest increases were rural, something Kornya said “really surprised us.”

That, in turn, has meant the percentage of eviction cases Iowa Legal Aid has taken on has increased from 25% pre-pandemic to close to 50% now.

[inline-ad id=”5″]

The vast majority, he said, are for one simple reason: Renters can no longer pay.

“Our numbers show 90 to 95% of evictions, in general, are nonpayment of rent,” Kornya said. “It’s an economic issue.”

Employers still paying only the minimum wage?

Even in a time of rising wages to combat a labor shortage, there are plenty of places that offer just $7.25 per hour.

You can be a soap maker in Sioux City, a bartender in Ankeny or a housekeeper in Cedar Falls, all of which offer minimum wages on job site board Indeed. You can also find such wages as a line cook in Clinton, staffing an aquatics center in Indianola and delivering pizzas in Eldridge.

There’s even an opportunity to be a “lead teacher” at a central Iowa child care center, which asks prospective candidates for at least one year of experience in child care and notes they are expected to work 10-hour shifts and train “all support staff/assistant teachers as needed.” All for $7.25 per hour.

Of course, you can also legally be paid less than the minimum wage:

- Servers, bartenders and other “tipped workers” legally have their tips counted toward their wage, meaning employers can pay as little as $4.35 per hour.

- For the first 90 days of employment, an Iowa employer only has to pay you $6.35 an hour.

- If your employer makes less than $300,000 in sales or business per year, they don’t have a minimum wage at all!

Iowa’s minimum wage—along with the US’s as a whole—hasn’t been raised since July of 2009, the longest stretch of time the federal government hasn’t raised it since it was enacted in 1938. During that 13-years-and-counting, meanwhile, everything else has gone up in price, from groceries to housing to transportation (a gallon of gas in July of 2009 was $2.53!).

[inline-ad id=”6″]

A report last year showed minimum wage had lost 21% of its value during that time.

Some have been working nearly that long to change that: Fight for $15, an effort to raise the minimum wage in the US to $15 an hour, is now 10 years old. Congressional representatives have introduced the Raise the Wage Act for the last few years, which would match Fight for $15’s ask, and tie future minimum wage increases to similar increases in the country’s median wage.

And while those efforts have made gains—federal contractors now must be paid that wage, and the $15 minimum is now in place in some cities and California—the country as a whole, and 19 states including Iowa, remain stuck.

How did we get here? And how do we fix it?

How did minimum wage start?

If you think convincing Congress to raise the minimum wage is difficult these days, let’s travel back in time to the 1930s, before labor laws existed at all.

Child labor was rampant, bosses kept people on the job with no breaks for as long as they liked, and workers took home literal pennies for their efforts—all enforced by the Supreme Court’s laissez-faire attitude toward the working class.

Finally, in 1938, after much congressional wrangling and compromise, President Franklin Roosevelt signed the Fair Labor Standards Act. It included a minimum wage (25 cents, down from 40 thanks to protests from Southern states) a 44-hour weekly maximum, and a rule that employers couldn’t hire anyone under age 16.

It wasn’t much, and at that time it only affected about a fifth of US employers. But Roosevelt happily called it “legislation to end starvation wages and intolerable hours.”

In the decades since, as it’s risen slowly to where it stands today, the law has indeed kept up its bargain of eliminating “intolerable hours.” But a living wage? Not even close.

[inline-ad id=”8″]

Wages and the cost of living

“But you can’t compare Iowa to the rest of the country,” you might say, pointing out that Iowa’s cost of living is, by and large, a lot more affordable here than in higher-wage states.

You’re thinking of a “living wage,” where the wages you receive pay for the basic needs where you’re at. Based on that, $7.25 is no longer, if it ever was, a living wage—and, yes, that includes low-cost Iowa as well.

To make a “living wage” in Iowa, a single adult should make $16.18 per hour or $33,657 per year before taxes, according to a calculation by MIT. If you have a child, a living wage is $32.77 while the poverty wage is $8.38.

Minimum wage for a single parent, then, is a poverty wage, and by that metric, nearly 15% of all Iowa households are living in poverty, according to Common Good Iowa. That’s even worse for single adults (more than 26%) and astoundingly bad for single parents, nearly half of whom can’t meet a basic-needs budget.

By that metric, Iowa is squarely in the bottom half of states when it comes to workers making a comfortable living, according to Oxfam, which ranked Iowa 35th in the nation last year.

The race to the bottom

Did you know that those living in poverty actually pay more for goods and services? As The Daily Beast noted in a 2017 article, “It’s expensive being poor.”

It’s called the “poverty tax,” and it works out to around 10% more than those on a living wage. Here’s how:

Can’t afford to pay all your bills on time? Now, you’ve also got late fees and a higher interest rate you can’t afford, either. Don’t have a credit card because your score is too low? Rent-to-own companies will be happy to charge you double for the furniture you need. Credit scores make everything from cars to homes more expensive as well through higher interest rates. That’s how those in poverty get trapped in cycles of debt, unable to escape.

But there are more insidious examples. Like thinking you’re shopping at a discount grocery store, and getting absolutely fleeced instead.

[inline-ad id=”8″]

Ultra-low-cost stores like Dollar Tree and its subsidiary Family Dollar, along with Dollar General, accounted for nearly half of all new stores opening in the US in 2020. Those stores, plus Five Below and southwestern US-based 99 Cents Only Stores, accounted for more than 34,000 storefronts around the country, growing at a rate faster than any other retailer.

Dollar Tree alone is in 59 different cities in Iowa, more than even Walmart’s 54 cities. Family Dollar is in 23 cities, and Five Below is in 11. But nobody beats Dollar General, which claims locations in a whopping 254 cities, or well over a quarter of the entire state’s 947 towns.

Despite its name and reputation, Dollar General isn’t actually cheaper than other stores. In fact, pound-for-pound, Dollar General charges much higher prices across a range of grocery staples, including more than 50% for chicken compared to its cheapest competitor, according to a recent investigation by More Perfect Union.

Customers think they’re paying less, but they’re actually paying more money for less product. It’s the poverty tax, but better hidden.

Who is the problem?

Congress could raise the minimum wage today, if they wanted.

If the Raise the Wage Act passed, minimum-wage workers would see their pay rise to $15 an hour by 2025. That would lift an estimated 3.7 million people out of poverty, including 1.3 million children, according to the Economic Policy Institute.

The Congressional Budget Office estimated that Americans would make an additional $509 billion in the first 10 years after the law was passed, more than offsetting the $175 billion lost through decreases in employment.

The bill has been introduced every term since 2017, but only passed the US House once, in 2019—with Democrats leading the charge.

[inline-ad id=”0″]

In Iowa, in 2019, three of our four House members were Democratic, and all three voted to pass the bill. Democratic Rep. Cindy Axne, the only one still in office, voted to pass. The lone Republican, former US Rep. Steve King, voted against it. It was defeated in the split Senate, however.

The Iowa delegation today—three out of four House members are now Republican—would likely go the opposite way.

Republican Reps. Randy Feenstra, who represents western Iowa, and Ashley Hinson, who represents northeast Iowa, were both members of the Iowa Legislature in 2017, when a law barring cities and counties from enacting their own minimum wage hikes was passed. Both voted yes on that bill, with Feenstra leading the charge.

Hinson’s office noted her views have not changed, blaming President Joe Biden’s administration for inflation and saying Democrats needed to spend less.

A happy ending, for now

Recently, the Pietropintos caught a break: A couple of weeks ago, Pietropinto’s husband found work as a school custodian, which raised his wage and—for the first time in 19 years—came with health insurance and other benefits.

She remembers after their first paycheck, suddenly realizing the couple had “money left over.”

“I asked my husband if I’d forgotten a bill,” she said. “I thought, surely, I’d made a mistake and forgotten someplace where we owed money.”

For the first time in years, the couple had a dinner date “at a real, sit-down place!” Pietropinto recalled. “It was such a joy to leave a good tip for the server.”

But that doesn’t mean she’s stopped worrying. She knows how easily a financial situation can derail with the wrong luck.

“There is an underlying fear that ‘something’ will happen to make it all go away. Like a dream, I’m afraid I’ll wake up to the nightmare again,” she said.

Bacon, the IMPACT CEO, said that’s a common feeling—even though people who have never struggled think she’s reached some finish line.

“People would say (to me), ‘You did it,'” Bacon said. Even if she never slides back, she said, “the fact that I got out doesn’t negate the fact that those six or seven years were hell, and the impact that had later on me and my kids.”

By Amie Rivers

7/25/22

Have a story idea for me? Email amie at iowastartingline.com. I’m also available by text, WhatsApp and Signal at (319) 239-0350, or find me on Twitter, TikTok, Instagram and Facebook.

Iowa Starting Line is part of an independent news network and focuses on how state and national decisions impact Iowans’ daily lives. We rely on your financial support to keep our stories free for all to read. You can contribute to us here. Follow us on TikTok, Instagram, Facebook and Twitter.

[inline-ad id=”1″]

Support Our Cause

Thank you for taking the time to read our work. Before you go, we hope you'll consider supporting our values-driven journalism, which has always strived to make clear what's really at stake for Iowans and our future.

Since day one, our goal here at Iowa Starting Line has always been to empower people across the state with fact-based news and information. We believe that when people are armed with knowledge about what's happening in their local, state, and federal governments—including who is working on their behalf and who is actively trying to block efforts aimed at improving the daily lives of Iowan families—they will be inspired to become civically engaged.

Iowa Republicans make outlawing gay marriage key 2024 campaign priority

Iowa Republicans have made outlawing gay marriage a key goal in their 2024 party platform. During the Iowa GOP’s 2024 state convention on Saturday,...

Department of Justice says Iowa immigration law violates US Constitution

If Iowa doesn’t suspend the enforcement of its new immigration law by May 7, the state could face a federal lawsuit, according to the Des Moines...

Rushing: Iowa State president said the quiet part out loud

I want to thank Iowa State University President Wendy Wintersteen for doing us all a favor by finally saying the quiet part out loud: all the...

Iowa sets aside almost $180 million for year two of voucher program

Iowa has committed nearly $180 million in taxpayer funds to support private school tuition in the 2024-25 school year, which is almost $50 million...

Kalbach: Immediate action needed on corporate ag pollution

Iowa agriculture has undergone substantial changes over the past 40 years. We see it all around us. Rather than crops and livestock being raised on...

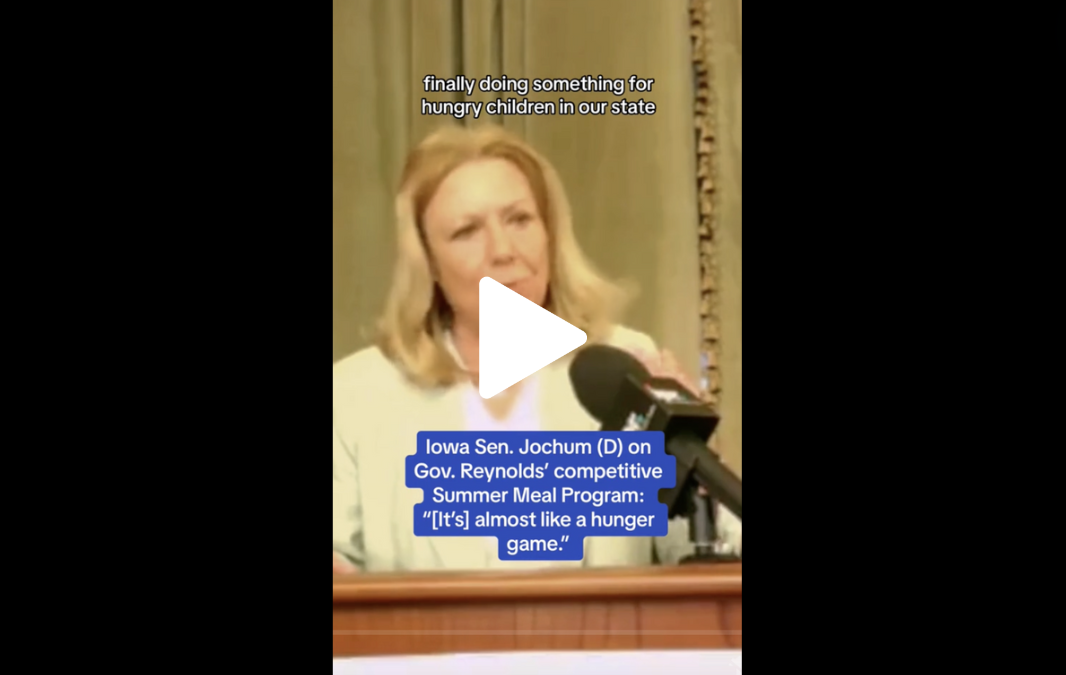

VIDEO: Jochum calls Gov. Reynolds’ summer meal program a ‘hunger game’

Iowa Gov. Reynolds announced a competitive $900,000 grant program to feed Iowa children over the summer, months after she declined $29 million in...