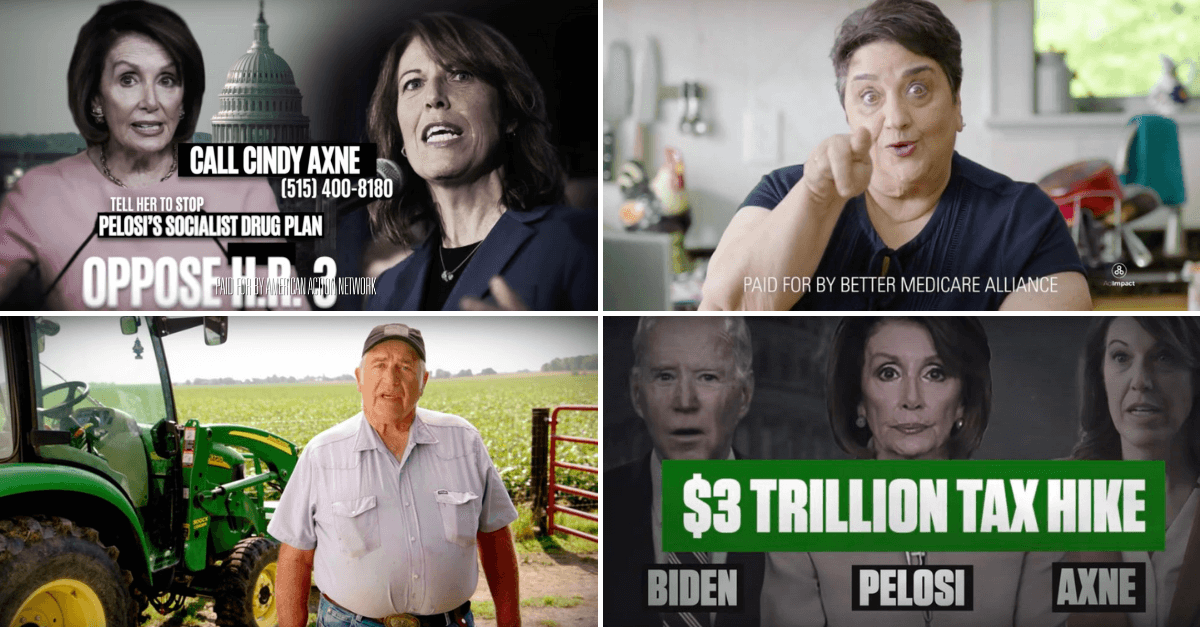

Groups working against US Rep. Cindy Axne have poured more than $2 million in TV advertisements to attack her and the broader Democratic agenda in 2021, well over a year before the election.

The ads connect Axne, Iowa’s lone congressional Democrat, to pieces of the party’s Build Back Better Act, and paint attempts to close tax loopholes and lower drug prices as attacks on everyday Americans.

Often, the ads either mislead, exaggerate, or don’t mention how a policy will actually affect middle-class Iowans.

Here’s a case-by-case look at the claims made and the actual truth—or lack of it—behind them.

The Ad

American Action Network: Axne, What’s A Life Worth?

The Claim

A Democratic plan to lower drug prices amounts to a government takeover and could prevent necessary new drugs from being made. It also claims the bill would put Washington, DC, in control of the prescription drug market.

The Truth

The ad is talking about HR 3, the Elijah Cummings Lower Drug Costs Now Act, which would allow Medicare and the Department of Health and Human Services (HHS) to negotiate drug prices.

Pharamaceutical companies set prices and do so with an eye for profit. This bill would allow the HHS to negotiate maximum prices for brand-name drugs that don’t have generics. Maximum prices would be judged against the prices in other countries.

The bill also changes Medicare’s drug coverage and pricing. The goal is to reduce the threshold for out-of-pocket spending for prescription drugs.

The ad borrows talking points from the pharmaceutical industry. The group also happens to financially backed by the pharmaceutical industry.

Critics, such as large drug companies, argue this will limit what companies can spend on research and development. However, most research and development gets its crucial funding from nonprofits and the public. So the development of new drugs wouldn’t be affected the way the ad suggests.

[inline-ad id=”2″]

The Ad

National Republican Congressional Committee: Tax Hikes

The Claim

Taxes will go up for everyone under the Democrats’ plan, which will hurt small businesses and families.

The Truth

The ad’s underlying insinuation that increased taxes will hit the middle class is simply false. One article mentioned in the ad is specifically about Democratic proposals to raise taxes on corporations and individuals who make millions. The ad declines to mention that tax increases for individuals target the very top of the tax bracket, which is currently 37% for singles with a taxable income over $500,000. Under the new rule, that would be 39.6% for taxable income over $400,000.

Another cited article in the ad comes from CNN, about how inflation is outpacing the increased compensation people have gotten. It suggested that because inflation is increasing while Biden is president, it’s his fault and so higher taxes would be bad for people. That’s also wrong. Inflation is caused by a number of things, including government spending last year before Biden took office.

[inline-ad id=”3″]

The Ad

Building America’s Future: Rep. Axne: Stop The Biden Tax Hikes

The Claim

Democratic plans to increase capital gains taxes and eliminate stepped-up basis would hurt family farms, and the ability for those farms to be passed down.

The Truth

The change to the capital gains tax would apply to all accumulated gains when the asset owner dies. Simply, President Joe Biden and Rep. Cindy Axne have both said family farms would be exempt from changes to capital gains taxes. The purpose of the change is to eliminate another way wealthy people try to avoid paying their fair share of taxes.

The plan also has exemptions for individuals ($1 million in estate gains and $250,000 in gains on personal residence) and married couples ($2 million in estate gains and $500,000 on a personal residence). Family farms would only be subject to the tax when assets are sold or the farm is no longer family-owned and operated.

Gains above those amounts would be subject to tax at death.

[inline-ad id=”4″]

The Ad

Better Medicare Alliance: Medicare Advantage

The Claim

Democrats are raising premiums in Medicare and cutting parts of Medicare Advantage.

The Truth

The ad doesn’t detail anything about what Democrats are doing that would raise premiums, but what it’s probably referring to is proposals to expand Medicare to cover vision, dental, and hearing.

Some Medicare Advantage plans cover those, but Medicare Advantage itself works a lot more like private insurance than traditional Medicare and there are limits to the doctors and hospitals people can use.

Basically, to pay for that expansion, some parts of Medicare Advantage could see an increase in premiums and/or benefit cuts.

This is because research shows some adjustments to Medicare Advantage payment formulas could prevent overpayments, which would help pay for the overall expansion. But that part of the bill isn’t settled yet and Axne is not talking about cutting Medicare Advantage or raising the premiums.

[inline-ad id=”5″]

The Ad

Common Sense Leadership Fund, a Republican-aligned PAC: this is a similar ad running in Michigan

The Claim

Democrats are taxing the retirement accounts of everyday Americans

The truth

The proposed tax change would only affect people who have more than $10 million in retirement funds. Estimates show the change would only affect 3,600 taxpayers out of the millions who have individual retirement accounts (IRAs) because only people who make more than $400,000 a year (or $450,000 for couples filing jointly) would be prevented from adding more money to the account once it reaches $10 million.

The rule change would also keep those 3,600 people from transferring money between their traditional IRAs and Roth IRAs. Because Roth IRAs are taxed when the money goes in, some use this strategy to avoid paying those taxes. Traditional IRAs are taxed after withdrawal.

Here’s a further fact check on this claim.

by Nikoel Hytrek

Posted 10/26/21

[inline-ad id=”1″]

Support Our Cause

Thank you for taking the time to read our work. Before you go, we hope you'll consider supporting our values-driven journalism, which has always strived to make clear what's really at stake for Iowans and our future.

Since day one, our goal here at Iowa Starting Line has always been to empower people across the state with fact-based news and information. We believe that when people are armed with knowledge about what's happening in their local, state, and federal governments—including who is working on their behalf and who is actively trying to block efforts aimed at improving the daily lives of Iowan families—they will be inspired to become civically engaged.

Lanon Baccam wins 3rd District Dem primary, will face Zach Nunn

Baccam defeats Melissa Vine to challenge Republican incumbent Lanon Baccam defeated Melissa Vine in Tuesday’s Democratic primary for Iowa’s 3rd...

Hardin County man running for office as Trump-loving Democrat to local party’s dismay

Brad Rewoldt, who recently changed his party affiliation from Republican, says his support of Trump will probably 'piss off' Democrats There is a...

Scheetz: Tax cuts for all Iowans, not just the wealthy

State Rep. Sami Scheetz says all Iowans should benefit from tax cuts via a sales tax reduction As a state representative, my job is to serve the...

Kalbach: What Iowa Republicans focused on during legislative session

Our state legislative session finished up towards the end of April, and I’m glad it’s over! From further de-funding and privatizing our public...

Advocates file suit to stop Iowa’s ‘unconstitutional’ immigration law

Immigration advocates filed a federal lawsuit Thursday to stop Iowa’s new immigration law—SF 2340—from taking effect arguing that the legislation...

Iowa Republicans make outlawing gay marriage key 2024 campaign priority

Iowa Republicans have made outlawing gay marriage a key goal in their 2024 party platform. During the Iowa GOP’s 2024 state convention on Saturday,...