Photo by Gage Skidmore

The effort to help Americans (and Iowans) recover from the COVID-19 pandemic continues.

In addition to an extended filing deadline for taxes and the waiving of unemployment taxes, Americans will also receive an increased tax credit for dependent children for 2021.

The new value is $3,000 for every child ages 6-17 and $3,600 for every child under 6. The amount varies based on the ages and number of children, as well as the family’s adjusted gross income (AGI), the total gross income minus deductions. The credit is also available to people who don’t have an earned income for the year, and the credit is fully refundable.

Payments for the child tax credits will likely come in monthly increments to families.

This change is a result of the Biden administration’s American Rescue Plan, passed to assist Americans with recovery from the economic losses caused by the COVID-19 pandemic. It’s also known as the stimulus package.

[inline-ad id=”2″]

The higher number applies to most people. It phases out at an income of $75,000 for single filers, $112,500 for head-of-household returns and $150,000 for joint returns.

Democratic Iowa State Sen. Claire Celsi said this tax credit will go a long way toward helping out the people on the fringes of Iowa’s economy, and be a “game-changer” for them.

“People have been pushed down for far too long,” she said. “This was just one really nice bright spot where a hand was actually being extended to them. And nobody deserves it more than people with children.”

Celsi said the tax credit will benefit the whole economy too, not just the people who have children. Because the money will go toward purchases like rent, groceries, car payments and other necessary things people have pushed off.

[inline-ad id=”3″]

For example, her daughter, a single mom, used money she received to buy new tires, car maintenance she’d been putting off.

“People buy things and this money gets injected straight back into the economy,” Celsi said. “So you’ll see, you know, grocery stores getting some of the money, clothing stores getting some of the money. And that just that creates jobs. So it’s a ripple effect and it’s good for the entire economy.”

Generally, the amount Iowans receive will be determined from 2019 and 2020 tax returns, but the American Rescue Plan requires the IRS to develop an online portal so people can update their information, including the number of children or changes in income.

[inline-ad id=”4″]

The benefit will be paid out to eligible families in advance, monthly from July to December this year, but people can opt out of that option if they want. Those payments will be half of the 2021 tax credit (with the other half to be claimed on 2021 tax returns) and the amount per month will vary depending on the number of children a family has.

And it continues the trend of individuals getting direct help from the federal government during difficult times.

“I think we’ve gotten used to government helping big banks and big business when things go south. Let’s not forget that,” Celsi said. “And I think the reason why our economy didn’t tank during the recession is because of these extra payments that people have been getting.”

[inline-ad id=”5″]

To qualify, children must have a valid Social Security number, must be related to you and live with you at least half the year, and you must provide more than half of your child’s financial support.

“Any family with children, especially children under the age of 6 during 2021 will benefit from this,” said Allan Reynolds, an accountant in Sioux City.

In April, President Joe Biden released his American Families Plan, which calls for a four-year extension for this new tax credit. Some Democrats in Congress are pushing for it to be permanent.

by Nikoel Hytrek

Posted 5/14/21

[inline-ad id=”1″]

Politics

AEAs cutting workers in wake of Republican legislation

Iowa legislators said a new bill cutting money for agencies that help students with disabilities wouldn't affect services. But area education...

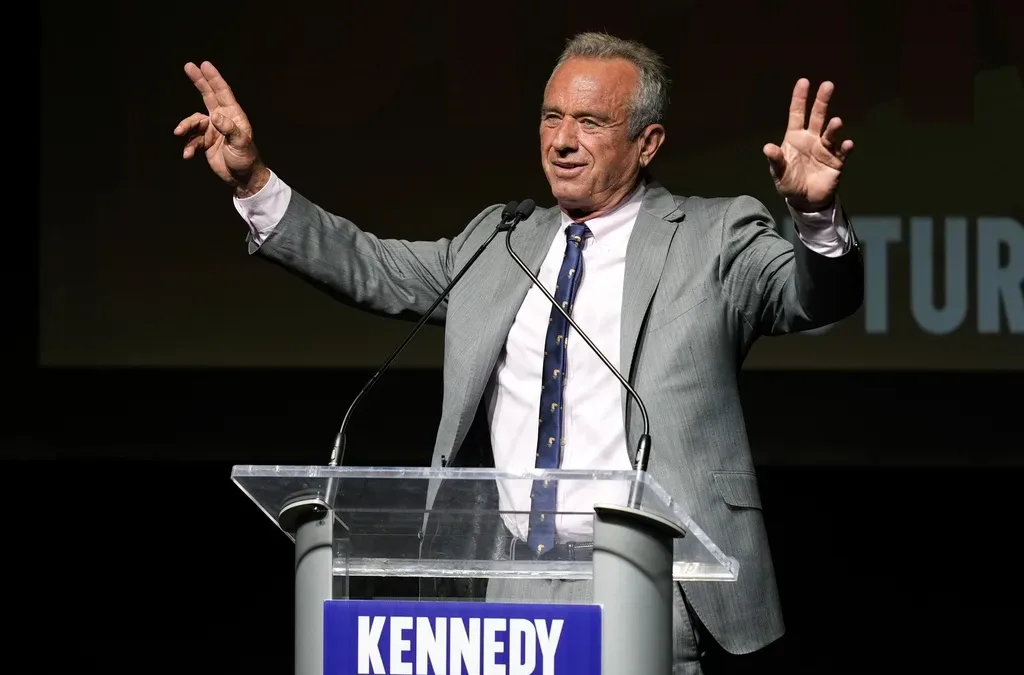

He said what? 10 things to know about RFK Jr.

The Kennedy family has long been considered “Democratic royalty.” But Robert F. Kennedy, Jr.—son of Robert F. Kennedy, who was assassinated while...

Local News

No more Kum & Go? New owner Maverik of Utah retiring famous brand

Will Kum & Go have come and gone by next year? One new report claims that's the plan by the store's new owners. The Iowa-based convenience store...

Here’s a recap of the biggest headlines Iowa celebs made In 2023

For these famous Iowans, 2023 was a year of controversy, career highlights, and full-circle moments. Here’s how 2023 went for the following Iowans:...