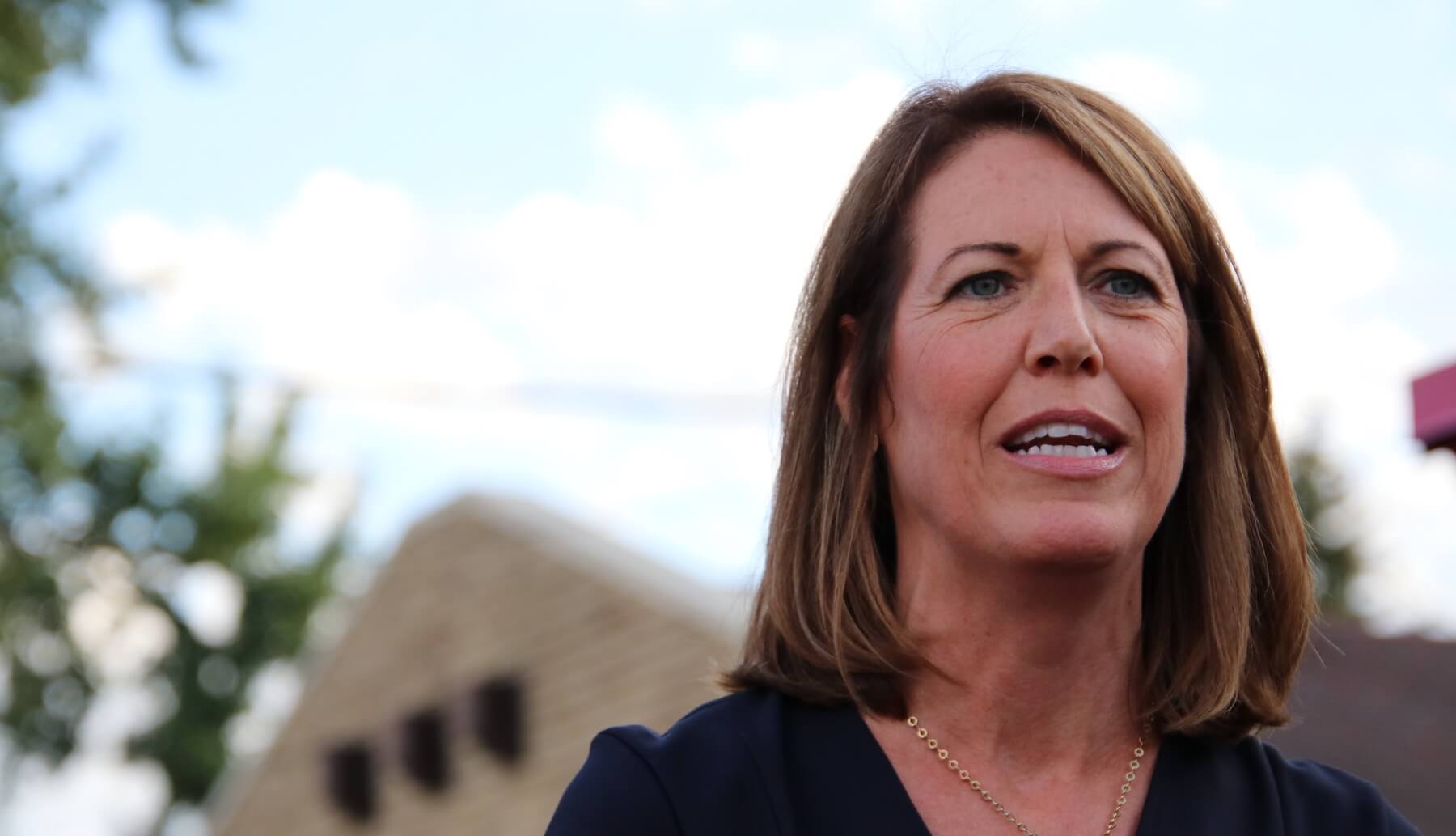

Photo by Julie Fleming

If at any time last year you received unemployment benefits, a portion or all of those benefits will not be taxed.

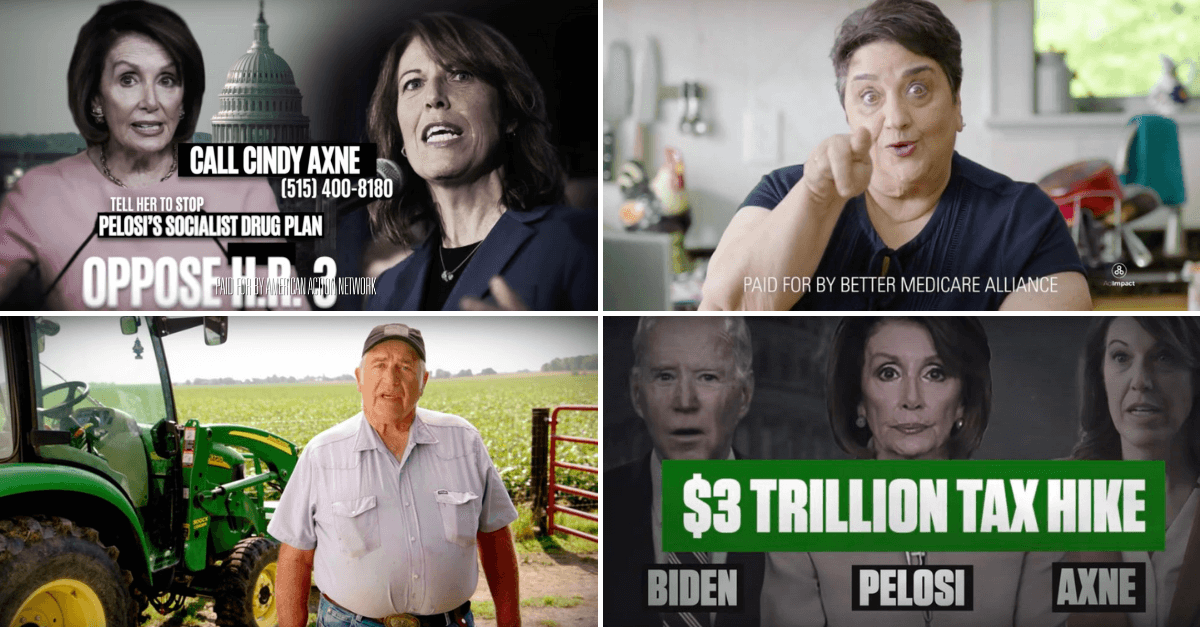

Iowa’s Democratic Rep. Cindy Axne worked with Illinois Sen. Dick Durbin (D) to add a provision to President Joe Biden’s American Rescue Plan, the COVID-19 relief bill, that would waive the first $10,200 of unemployment benefits for people who earned less than $150,000 this season.

That means people who received unemployment benefits won’t have to pay taxes on some or all of those benefits, potentially saving them hundreds of dollars, if not more.

For people who have already filed their taxes, the IRS will automatically calculate the correct amount that should be taxed and either refund the extra or apply it to other outstanding taxes.

There is no need to file an amended return, they say.

[inline-ad id=”1″]

For people who haven’t filed yet, online tax software has been updated, so taxpayers can answer questions when prompted. The IRS also has a guide to calculating the exclusion.

Normally, unemployment benefits are taxed like ordinary income with the same tax rates. This season, $10,200 are automatically excluded.

“This commonsense fix that Senator Durbin and I introduced [in February] will protect families, promote economic stability, and ensure that the additional benefits that we provided through the CARES Act last year stay in the pockets of those in need instead of on their tax bills,” Axne said in a press release earlier this year.

“It was huge. It’s definitely going to target people that were unemployed, that were having difficulty making their bills,” said Allan Reynolds, an accountant in Sioux City. “They give you a deduction for it, which in turn could possibly be two months of rent. In Iowa it could easily be two months of rent.”

[inline-ad id=”3″]

He said people are keeping—or being refunded—more money, which will ultimately help the economy, and afford people more stability, especially those who struggled in 2020.

Last year, the number of Iowans receiving unemployment benefits spiked in March and peaked in April at 204,175. The number steadily decreased after that, falling below a hundred thousand in August. As of March this year, the number of recipients now stands at 44,741 about where it was March 2020.

“The effect is, hopefully it’ll put money back into pockets. And we definitely saw that,” Reynolds said. “People that had unemployment with the change of the law in the middle of tax season definitely saw a nice tax savings.”

by Nikoel Hytrek

Posted 5/12/21

[inline-ad id=”2″]

Politics

Biden cancels student loan debt for 2,690 more Iowans

The Biden administration on Friday announced its cancellation of an additional $7.4 billion in student debt for 277,000 borrowers, including 2,690...

The Republican war on Medicare raises the stakes in 2024

Nearly 670,000 Iowans rely on Medicare benefits—benefits they spent decades paying into, with the promise that the program would be there for them...

Local News

No more Kum & Go? New owner Maverik of Utah retiring famous brand

Will Kum & Go have come and gone by next year? One new report claims that's the plan by the store's new owners. The Iowa-based convenience store...

Here’s a recap of the biggest headlines Iowa celebs made In 2023

For these famous Iowans, 2023 was a year of controversy, career highlights, and full-circle moments. Here’s how 2023 went for the following Iowans:...