The Business Record described two projects that will receive the maximum of “brownfield” and “grayfield” Iowa Income Tax Credits. Brownfield credits are for sites that have “real or perceived environmental contamination” and Grayfield credits are for “vacant or blighted sites.” “A $40 million conversion of the 104-year-old Midland building at 206 Sixth Ave. from an office building to luxury hotel received a maximum brownfield tax credit of $400,000. Chicago-based Aparium Hotel Group plans a 140-room, full-service, four-star hotel that will include a restaurant, ballroom and meeting spaces.”

The application of brownfield credits for the conversion of a downtown office building to a four-star hotel stretches credibility—where is the real or perceived environmental contamination? If the office building has asbestos that needs removal as a criterion for receiving state tax credits, where will this stop? Many older buildings in the metro area have asbestos. If the state is giving away tax credits for de-contaminating all older properties, who gets them and who doesn’t? Hmm.

Another maximum $400,000 in grayfield credits was awarded by the Iowa Economic Development Authority Board for the $4.3 million redevelopment of a parking lot on Third Avenue. “The project calls for a three-story, 22,830-square-foot office building with an art studio on the ground floor, according to a staff report to the IEDA Board.” If the rationale for granting grayfield credits is underutilized land in the heart of downtown, I have a bridge to sell to the IEDA. The conversion of a high value downtown parking lot to an office building as a grayfield project is a stretch. Vacant or under-utilized land remains that way until the market justifies development. But the injection of public funds into real estate development has become a slippery slope that favors those connected to politicians or with the expertise to game the system.

There are legitimate exceptions. As a developer, I have used Low Income Housing Tax Credits to develop rent-restricted apartment properties. These are Federal income tax credits that trade affordable rents for reduced income taxes. The costs of developing affordable housing precludes market-based development. The need for incentives for affordable housing is universally accepted. Some Urban Renewal public investments are justified by allowing public takeover of “blighted” properties to permit redevelopment that will stabilize neighborhoods. But some of these have been abused, converting middle class communities into gentrified, up-scale neighborhoods, displacing residents who have no place to go for affordable homes.

Tax credit give-aways are costing Iowa taxpayers millions of dollars in lost revenue for profitable businesses to move from one location to another in the same market. Other Iowa tax credits have been granted to highly profitable businesses costing taxpayers $400,000 for each job gained or even to companies as an award to reduce their number of job losses because they can’t compete in the marketplace.

These absurdities are the result of years of Republican “stewardship” and “promotion” of economic development.

Fifty years ago, public investment in economic development was limited to human resources—medicare, social security, public education—and infrastructure—dams, power grids, highways, mass transit, airports, water and sewer plants, etc. Investment in urban renewal was just getting started and blight was defined as uninhabitable, dilapidated property. Oh, how times have changed.

In a state with under 4% unemployment, where is the need for taxpayers to continue subsidizing the marketplace? If Apple, Facebook, Google or Amazon want to locate in the Des Moines metro area, each bringing in 50 jobs, they will do so based on the cost of land, availability of water and roads and energy. If they are seeking the biggest bribe, they should go somewhere else. Public sector investment in infrastructure may be necessary, but tax credit grants have become a pay-for-play game and their abuse has become unacceptable.

While the legislature has fed these boondoggles they have cut back on essential public investment in human services—education, health and natural resources, a legitimate and critical role of government. Even public investment in infrastructure has been decimated by misplaced priorities. The role of government should be providing essential public services, not as a hand maiden to private enterprise. Enough is enough!

by Tim Urban

Posted 11/1/17

Politics

Biden announces new action to address gun sale loopholes

The Biden administration on Thursday announced new action to crack down on the sale of firearms without background checks and prevent the illegal...

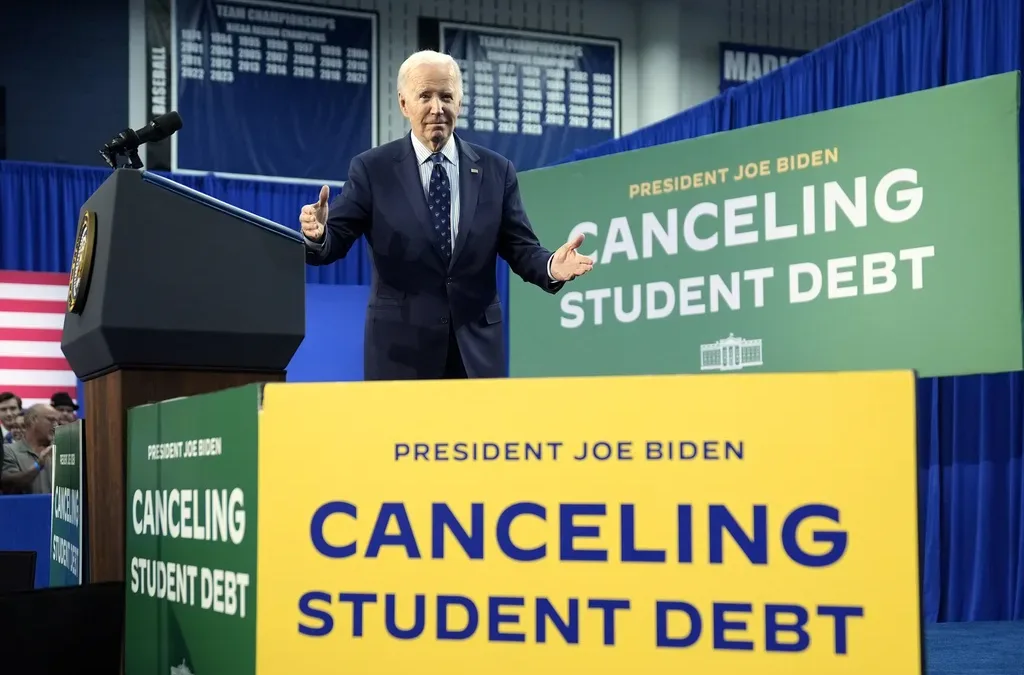

Biden cancels student loan debt for 2,690 more Iowans

The Biden administration on Friday announced its cancellation of an additional $7.4 billion in student debt for 277,000 borrowers, including 2,690...

Local News

No more Kum & Go? New owner Maverik of Utah retiring famous brand

Will Kum & Go have come and gone by next year? One new report claims that's the plan by the store's new owners. The Iowa-based convenience store...

Here’s a recap of the biggest headlines Iowa celebs made In 2023

For these famous Iowans, 2023 was a year of controversy, career highlights, and full-circle moments. Here’s how 2023 went for the following Iowans:...