Governor Kim Reynolds released her wide-ranging tax cut plan earlier today, which included a total of $1.7 billion in tax reductions for Iowa businesses and taxpayers. In-depth details of the proposal have not yet been made public, and the initial plan put out today essentially amounted to a bullet point press release of all the potential positive aspects of the bill.

The tax rate for the wealthiest Iowans will be slashed by about 23%, from 8.98% down to 6.9% – it will also now be applied to only people making $150,000 or more (currently it’s about $73,000 or more). Middle class Iowans making less income each year will also see tax reductions, but at lower cuts than the top earners. Businesses will get new ways to deduct certain expenses from their income taxes, as well. It also eliminates the alternative minimum tax, which would produce a windfall for corporations.

All in all, it sounds like a rather generous package of tax cuts that would decimate state revenue further in the midst of an all-out budget crisis that has seen Republican leaders continue to borrow over a hundred million dollars to cover basic expenses for the state. And that’s where the most laughable portion of Kim Reynolds’ tax cut proposal comes:

“The plan is projected to cut income taxes by $1.7 billion by 2023, while maintaining expected growth rates in revenue – even assuming no dynamic effect (economic stimulus) from federal or state tax reform,” Reynolds’ plan reads.

Yes, somehow reducing state revenue by $1.7 billion over five years will have no negative impact on expected revenue growth or the state budget. The money will simply reappear all on its own. That all seems… unlikely. It’s even more unlikely when you consider that Republicans made the same kind of promises back when the commercial property tax cut passed in 2013, which turned out to be a chief contributor to Iowa’s collapsing revenue numbers.

Interestingly, Reynolds’ plan also talks about revenue target “triggers” that will activate if an economic downturn slows revenue coming into the state, but it doesn’t specify exactly what those are.

“We already know that Governor Reynolds and Republicans have mismanaged the state budget, turned a surplus into a deficit, and put $144 million on the state’s credit card that still hasn’t been paid back,” Democratic State Representative Dave Jacoby said in response to the governor’s proposal. “While we are still reviewing the Governor’s plan, the devil is always in the details with new tax cuts. At first glance, her plan could cost well above $1.7 billion. We’ve seen similar tax cut plans passed in other states like Kansas with disastrous results. Iowa families have already been forced to pay higher property taxes and tuition to pay for hundreds of millions in corporate tax giveaways given out by the GOP the last few years.”

by Pat Rynard

Posted 2/13/18

Politics

AEAs cutting workers in wake of Republican legislation

Iowa legislators said a new bill cutting money for agencies that help students with disabilities wouldn't affect services. But area education...

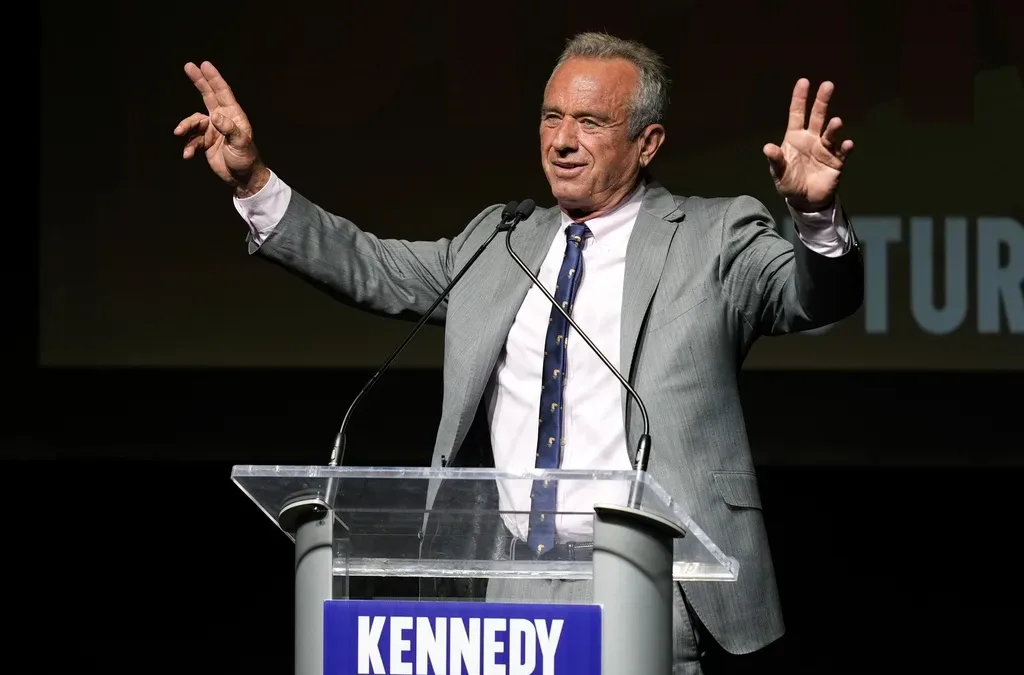

He said what? 10 things to know about RFK Jr.

The Kennedy family has long been considered “Democratic royalty.” But Robert F. Kennedy, Jr.—son of Robert F. Kennedy, who was assassinated while...

Local News

No more Kum & Go? New owner Maverik of Utah retiring famous brand

Will Kum & Go have come and gone by next year? One new report claims that's the plan by the store's new owners. The Iowa-based convenience store...

Here’s a recap of the biggest headlines Iowa celebs made In 2023

For these famous Iowans, 2023 was a year of controversy, career highlights, and full-circle moments. Here’s how 2023 went for the following Iowans:...