The Republicans have attempted to disguise their so called “Tax Reform” bill as a tax cut for the middle class. They hoped to zip this partisan, budget busting, wealthy rewarding, corporate welfare gimmick through Congress before anyone could see beyond the smoke and mirrors. Fortunately for the middle class, they weren’t quite fast enough in greasing their tax scam through the Senate. They got caught with their hands deep within the Federal taxpayer cookie jar, handing out goodies for their rich friends and their corporate donors. Their ridiculous claims that this is a middle class tax cut has been exposed as another “Big Lie” by both the major non-partisan tax specialists.

Congress has two official tax estimating bodies; the Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT). They both agree that this GOP Senate bill is a budget buster. Both the CBO and JCT assert that the Republicans’ numbers just don’t add up and the result will be a $1.5 trillion increase in the deficit.

The Washington Post broke down the CBO report by winners and losers. The Washington Post summary of the CBO report reached this conclusion:

“The GOP plan gives substantial tax cuts and benefits to Americans earning more than $100,000 a year, while the nation’s poorest would be worse off…by 2019, Americans earning less than $30,000 a year would be worse off under the Senate bill. By 2021, Americans earning $40,000 or less would be net losers, and by 2027, most people earning less than $75,000 a year would be worse off. On the flip side, millionaires and those earning $100,000 to $500,000 would be big beneficiaries, according to the CBO’s calculations.”

The Republicans are criticizing the CBO report claiming that the CBO is wrong. Guess who appointed the head of the CBO? The current CBO Chief, Keith Hall, was selected by the Republican House and Senate leaders. They appointed the CBO chief and called him an economic expert with “vast understanding” of economic policy. Then the official CBO fact-checker gave them an honest analysis that exposed their middle class tax cut was a big lie. They responded by throwing the CBO fact-checker under the bus.

The Washington Post article included the CBO calculation for the Senate’s proposed repeal of the Obamacare insurance mandate as well. This addition to the tax bill adds more pain by jeopardizing health insurance for millions.

“The Senate Republican tax bill eliminates the requirement that almost all Americans purchase health insurance or else pay a penalty. The CBO has calculated that health insurance premiums would rise if this bill becomes law, leading 4 million Americans to lose health insurance by 2019 and 13 million to lose insurance by 2027.

Paul Krugman, Nobel winning economist, wrote about the Senate tax plan this week in the New York Times Op-Ed. He called this tax bill the “biggest tax scam in history. “

“The core of the bill is a huge redistribution of income from lower- and middle-income families to corporations and business owners. Corporate tax rates go down sharply, while ordinary families are nickel-and-dimed by a series of tax changes, no one of which is that big a deal in itself, but which add up to significant tax increases on almost two-thirds of middle-class taxpayers.”

Krugman summarized the GOP bill, “So will they manage to pull off this giant con job? The reason they’re rushing this to the Senate floor without a single hearing, without a full assessment from Congress’s own official scorekeepers, is their hope that they can pass the thing before people figure out what they’re up to.”

The Senate is hoping to vote on their tax bill this week before the public has a chance to fully understand the implications of this massive tax change. Please call Senator Grassley and Ernst and express your opposition to this budget busting massive giveaway to the rich.

by Rick Smith

Posted 11/29/17

Politics

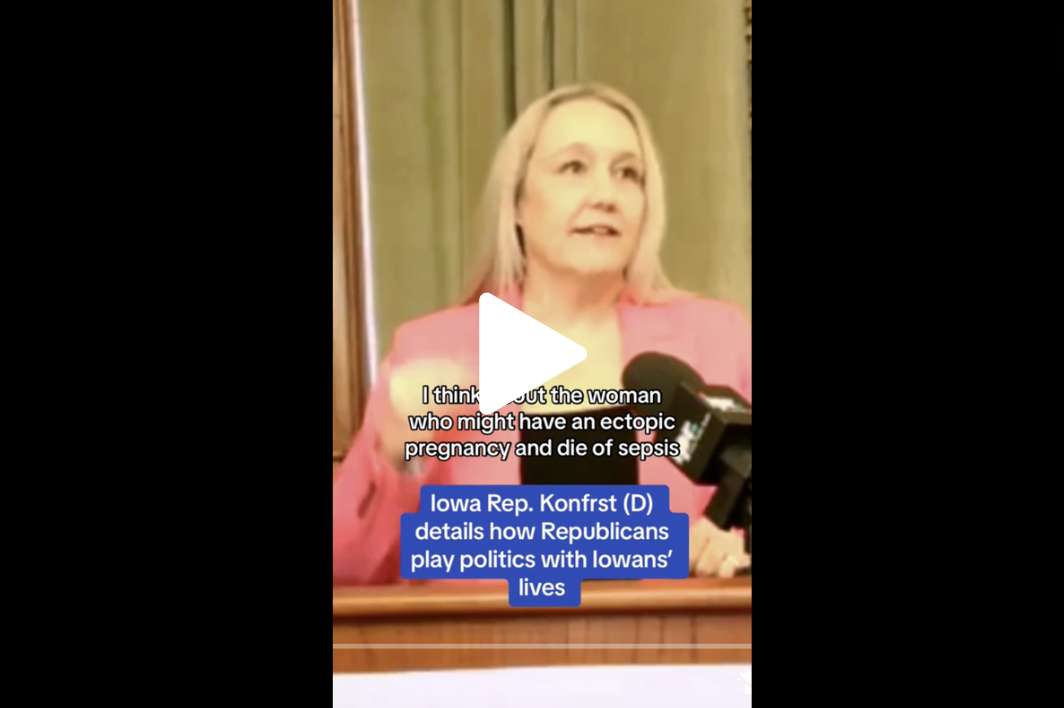

Abortion supporters rally before Iowa Supreme Court arguments

Abortion saved her life seven years ago and Leah Vanden Bosch is more grateful for it now than ever. Vanden Bosch, who serves as the development and...

New VA program to help more than 40,000 veterans stay in their homes

The Department of Veterans Affairs (VA) will launch a “last resort” program for tens of thousands of American veterans who are in danger of losing...

Local News

No more Kum & Go? New owner Maverik of Utah retiring famous brand

Will Kum & Go have come and gone by next year? One new report claims that's the plan by the store's new owners. The Iowa-based convenience store...

Here’s a recap of the biggest headlines Iowa celebs made In 2023

For these famous Iowans, 2023 was a year of controversy, career highlights, and full-circle moments. Here’s how 2023 went for the following Iowans:...